Shared Mobility

Services

“Shared mobility” is the deployment of innovative transport services using emerging technologies and original business models , based on shareability and the provision of on-demand service. Shared mobility services include car sharing, ride-hailing, micromobility (bike sharing, shared electric kick scooters) and on-demand micro-transit. Shared autonomous vehicle applications are also a rapidly emerging area, as many autonomous vehicles are likely to be initially deployed in the context of shared mobility services.

When shared mobility services are well deployed, managed and regulated, they have the potential to reduce the demand for private cars, thus reducing associated emissions. However, the impacts of shared mobility can vary depending on the kind of service, the specific operating context (including walking and cycling infrastructure), access to public transport and the general built environment. Enhanced data and information on these services, and a greater array of services for different purposes, have the potential to improve the economic conditions of lower-income populations.

The development and positioning of shared mobility services has been mostly led by the private sector. However, in recent years there has been an increase in alliances and partnerships led by both the private sector and non-governmental organisations, indicating a shared agenda towards increasing the presence of shared mobility services and improving their environmental performance. Yet in many cases, shared mobility services are still struggling to find a well-established regulatory framework in which to operate.

In response to the COVID-19 pandemic, many ride-hailing companies shifted their activities from moving people to moving goods (especially food delivery) in Asia and North America. The pandemic has had an asymmetric impact across shared mobility services, with bikes and e-scooters generally faring better than ride-hailing services. Recent reductions in funding (often linked to drops in revenue spurred by the pandemic) have put into question the financial sustainability of current shared mobility services business models.

Key Findings

-

Demand trends

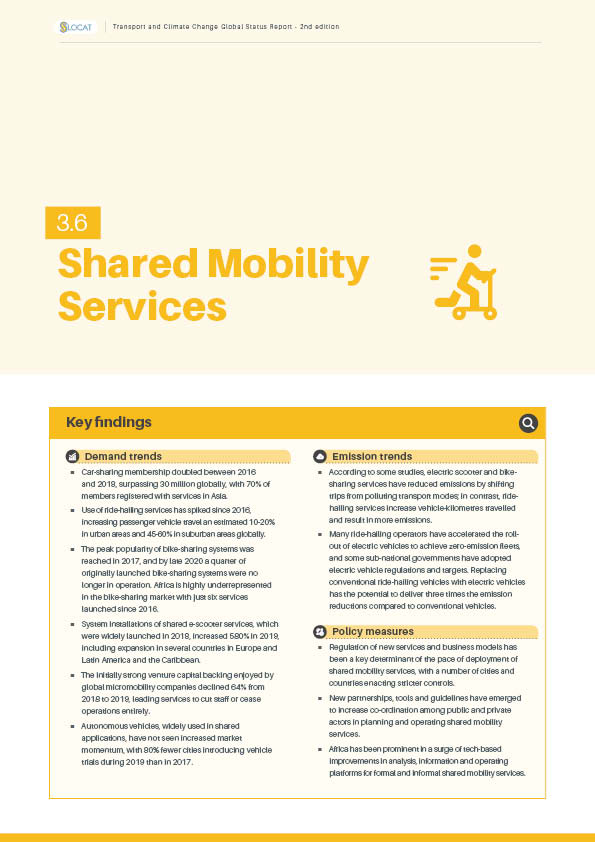

Car-sharing membership doubled between 2016 and 2018, surpassing 30 million globally, with 70% of members registered with services in Asia.

Figure 1.

Global car-sharing membership by region and total number of vehicles, 2006-2018

Use of ride-hailing services has spiked since 2016, increasing passenger vehicle travel an estimated 10-20% in urban areas and 45-60% in suburban areas globally.

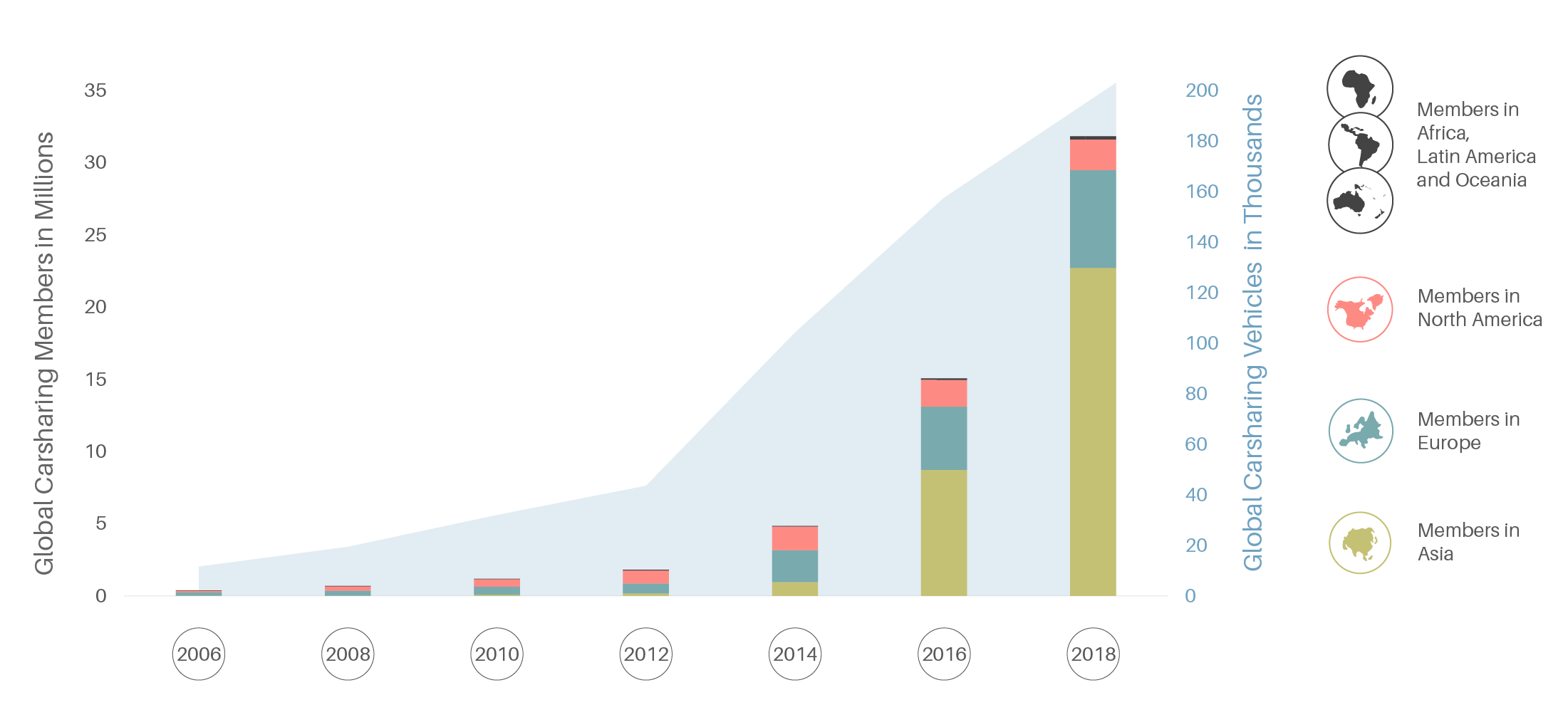

The peak popularity of bike-sharing systems was reached in 2017, and by late 2020 a quarter of originally launched bike-sharing systems were no longer in operation. Africa is highly underrepresented in the bike-sharing market with just six services launched since 2016.

Figure 2.

Total number and annual additions of bike-sharing systems, by region, 2007-2019

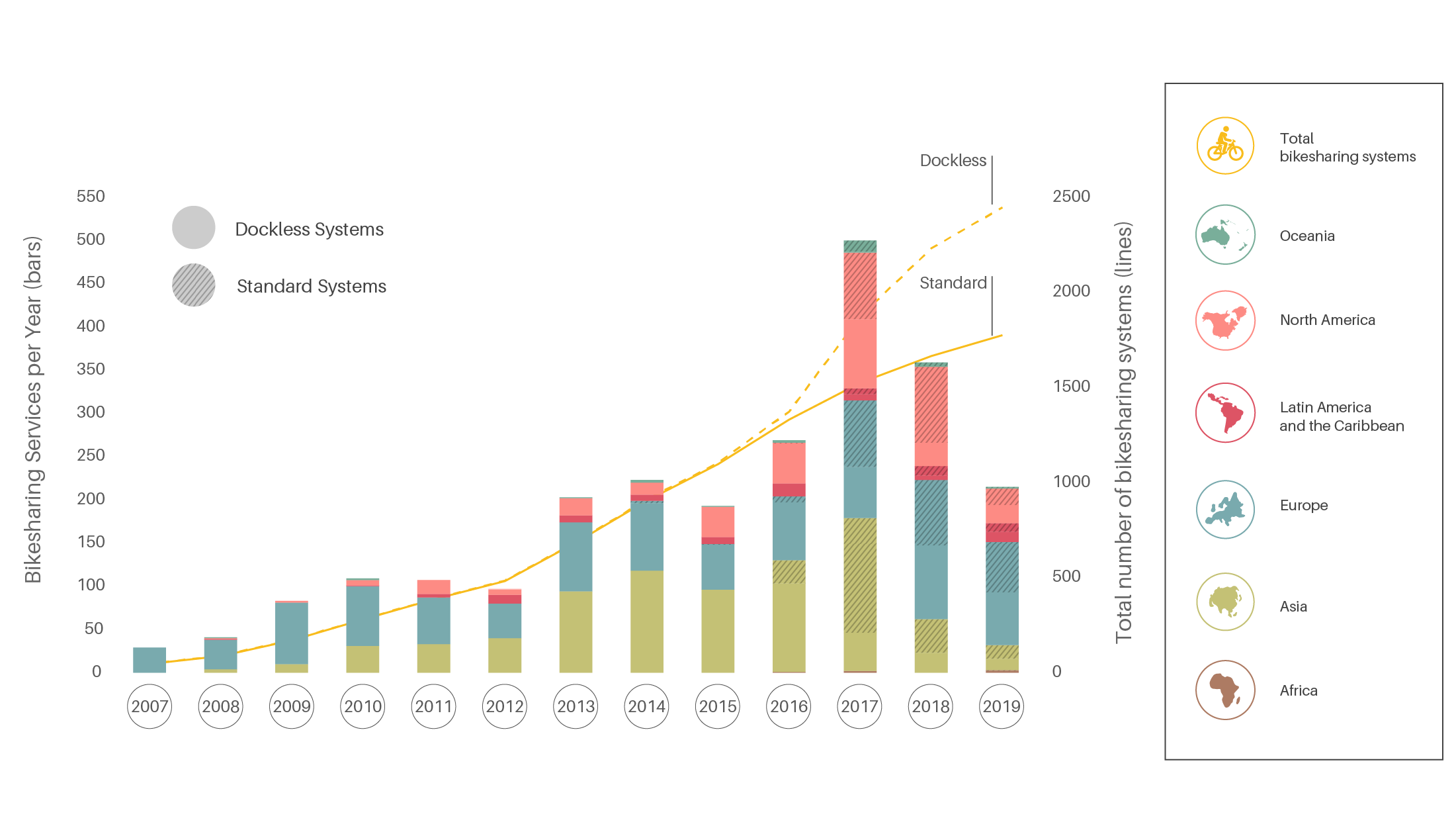

Figure 3.

Number and purpose of bike sharing, shared e-bike and shared e-scooter trips in the USA, 2010-2019

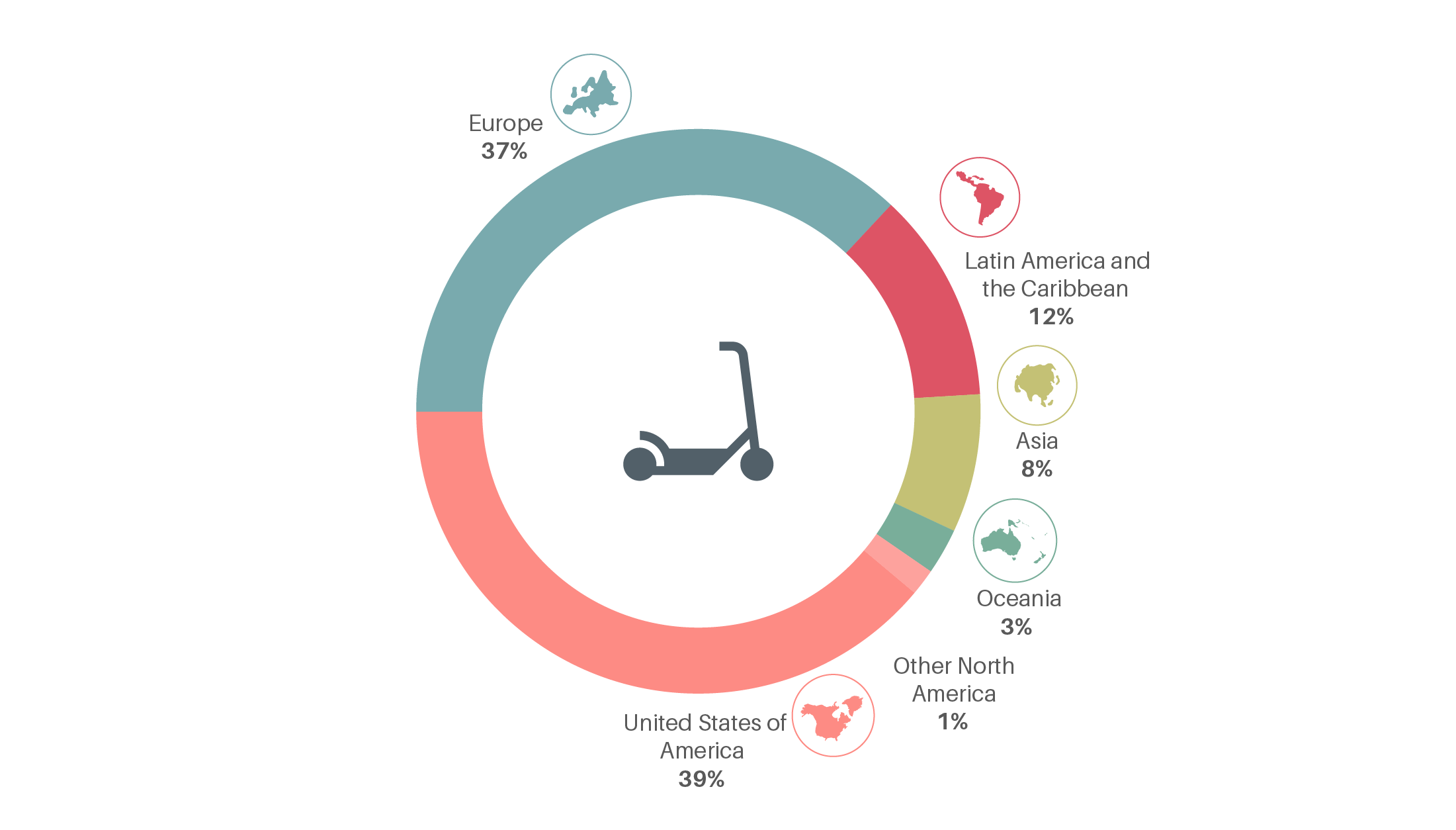

System installations of shared e-scooter services, which were widely launched in 2018, increased 580% in 2019, including expansion in several countries in Europe and Latin America and the Caribbean.

Figure 4.

Urban scooter services by region, early 2020

The initially strong venture capital backing enjoyed by global micromobility companies declined 64% from 2018 to 2019, leading services to cut staff or cease operations entirely.

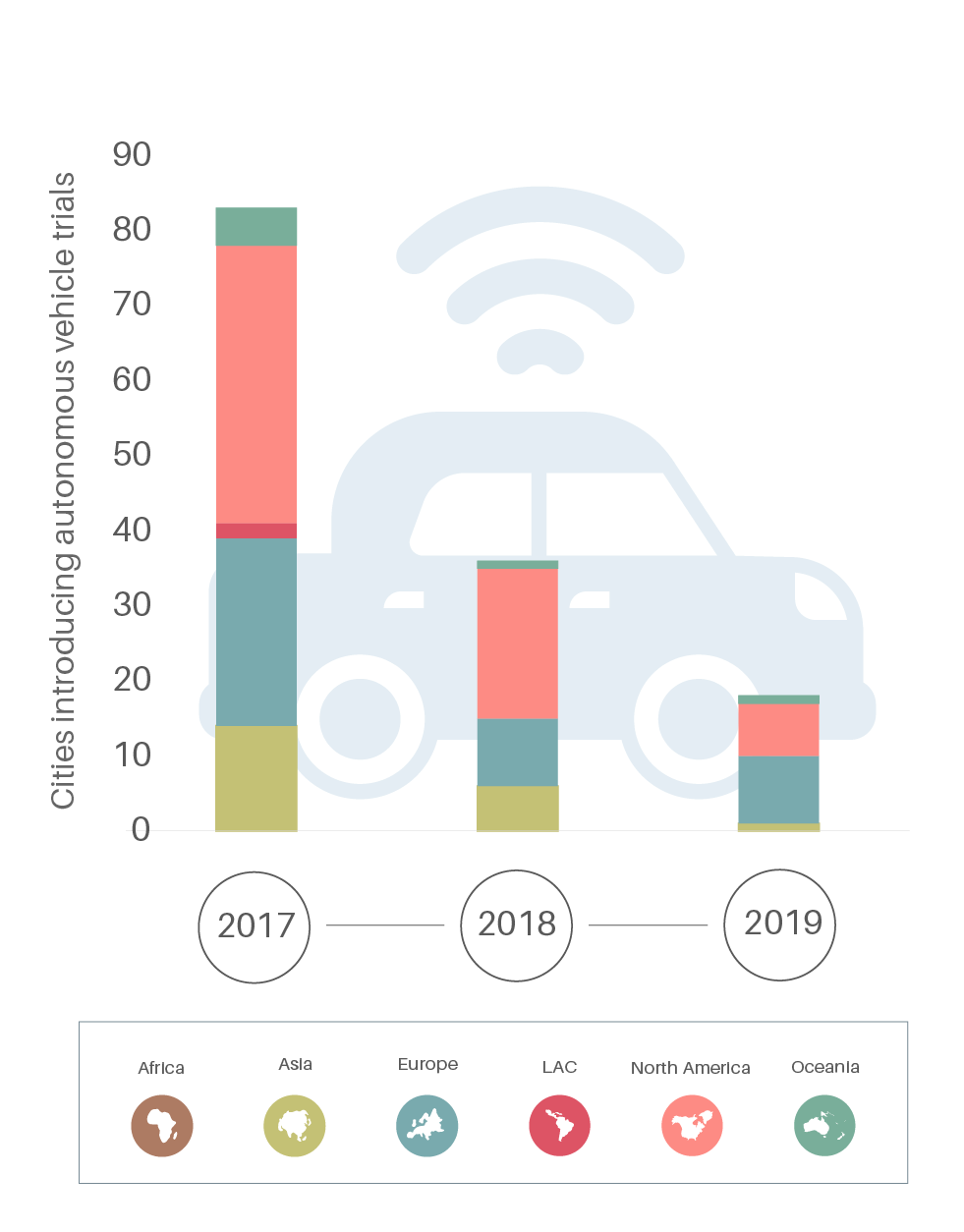

Autonomous vehicles, widely used in shared applications, have not seen increased market momentum, with 80% fewer cities introducing vehicle trials during 2019 than in 2017.

Figure 5.

New autonomous vehicle trials in cities, by region, 2017-2019

-

Emission trends

According to some studies, electric scooter and bike-sharing services have reduced emissions by shifting trips from polluting transport modes; in contrast, ride-hailing services increase vehicle-kilometres travelled and result in more emissions.

Many ride-hailing operators have accelerated the roll-out of electric vehicles to achieve zero-emission fleets, and some sub-national governments have adopted electric vehicle regulations and targets. Replacing conventional ride-hailing vehicles with electric vehicles has the potential to deliver three times the emission reductions compared to conventional vehicles.

-

Policy Measures

Regulation of new services and business models has been a key determinant of the pace of deployment of shared mobility services, with a number of cities and countries enacting stricter controls.

New partnerships, tools and guidelines have emerged to increase co-ordination among public and private actors in planning and operating shared mobility services.

Africa has been prominent in a surge of tech-based improvements in analysis, information and operating platforms for formal and informal shared mobility services.

-

Impacts of the COVID-19 pandemic

Several ride-hailing services lost ridership during pandemic lockdowns, leading to job losses in the sector, with ride-hailing company Ola cutting 35% of its workforce in India, and Uber cutting 23% of its global workforce.

Demand for bike-sharing services increased sharply in a number of cities in 2020, while in other cities, demand for bike sharing struggled to reach 2019 levels due to lockdowns and service restrictions.

Figure X.

Changes in bike-sharing use during the COVID-19 pandemic, in selected cities

Key indicators

2017*

2019*

% change

Key indicators

(# of countries)

2017*

2019*

% change

Key indicators

2017*

2019*

% change

Key indicators

2017*

2019*

% change

Key indicators

2017*

2019*

% change

Key indicators

2017*

(2016)

2019*

(2018)

% change

Key indicators

2017*

2019*

% change

(*) Data are for the indicated year unless noted otherwise.