Renewable Energy

in Transport

To achieve the energy transformation required for decarbonisation, the transport sector will need to rely increasingly on renewable energy sources. The main entry points for renewables in the transport sector are:

-

The use of biofuels blended with conventional fuels, as well as higher blends including 100% liquid biofuels;

-

Natural gas vehicles and infrastructure converted to run on upgraded biomethane; and

-

The electrification of transport modes, including through the use of battery electric and plug-in hybrid vehicles or of hydrogen, synthetic fuels, and electro-fuels, where the electricity is itself renewable.

Some renewable energy carriers (such as biofuels) can be used in the internal combustion engines of conventional vehicles, whereas others require alternative drivetrains, such as in battery electric or fuel cell vehicles. Overall, fuels and vehicle technologies vary greatly in their technical maturity, costs, level of sustainability, climate mitigation potential, distribution and acceptance rates among users. Renewable energy policy strategies are being implemented at different levels (from international to sub-national), and while some are relevant to the transport sector overall, others are specific to certain sub-sectors to accommodate the needs and preferences of different industries and users.

Plug-in hybrid and fully electric passenger cars, electric scooters, electric bicycles and electric waste trucks have become more common in an increasing number of countries, often as a result of policies and targets adopted in prior years. Although rarely linked directly to renewable sources, the use of electricity in transport continued in 2019 and 2020, offering greater potential entry points for integration with renewable energy. Public subsidies can reduce the cost of sustainable transport measures. However, fiscal support from governments has remained limited, and many governments continue to heavily subsidise fossil fuels or fail to adequately tax them, artificially lowering the retail price of petrol below the price of crude oil on the world market, which continues to undermine climate action (see Section 4 on Financing).

The COVID-19 pandemic led to a strong decline in oil demand as well as opportunities to shift investments towards renewable energy sources. Economic recovery packages offer significant potential to align renewable energy and sustainable transport policies (see Box).

Key Findings

-

Demand trends

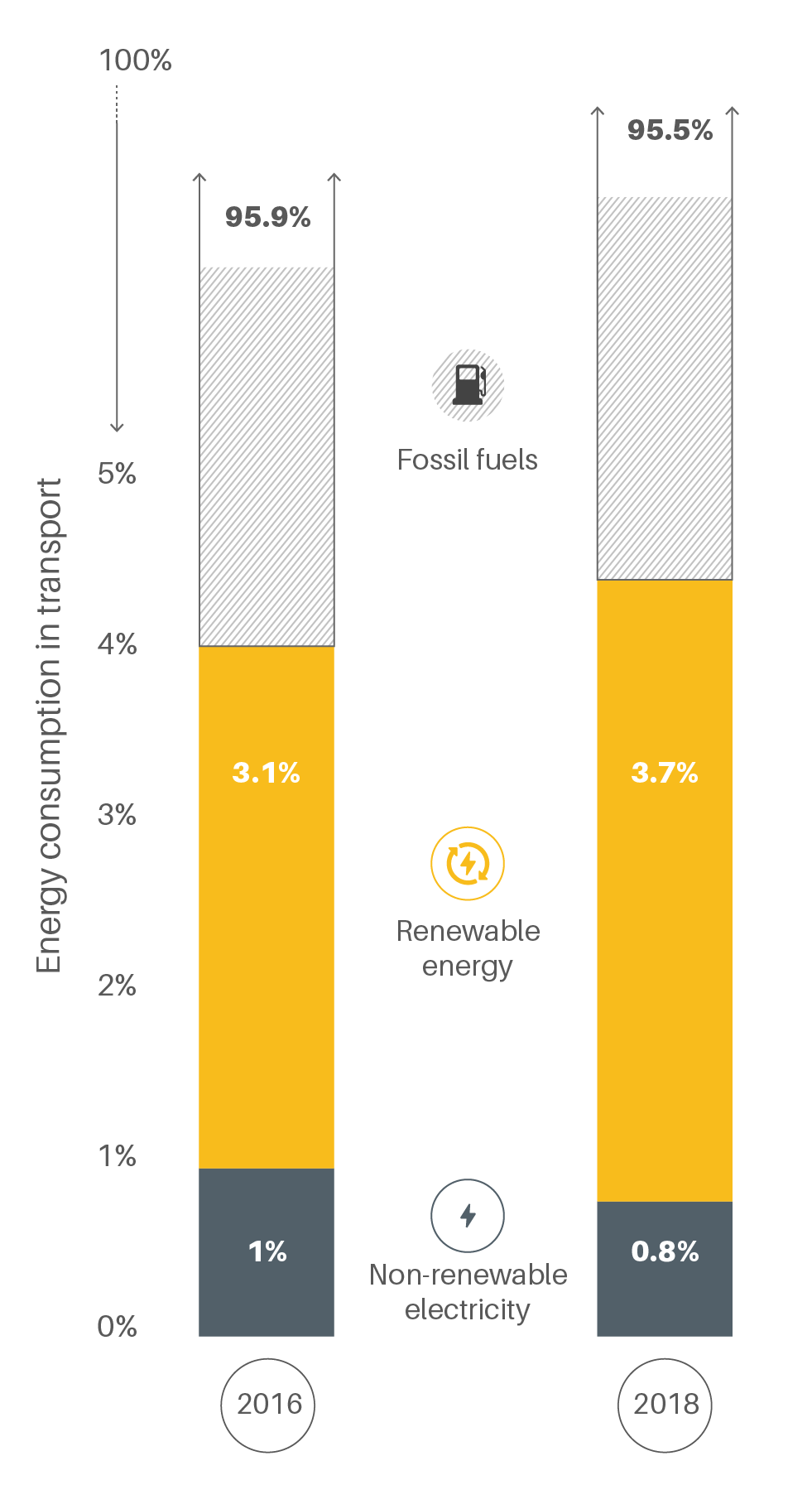

Transport remains the sector of energy use with the lowest share of renewables, with more than 95% of energy needs coming from oil and petroleum products and less than 4% from biofuels and renewable electricity in 2018.

Figure 1.

Share of renewable energy in transport, 2016 and 2018

Renewable energy sources – mostly renewable electricity and biofuels – contributed an estimated 11% of the energy use associated with global rail in 2019.

Biofuels accounted for 91% of the renewable energy use in road transport in 2019, but further growth in biofuels is constrained by sustainability issues and competition between fuel and food sources.

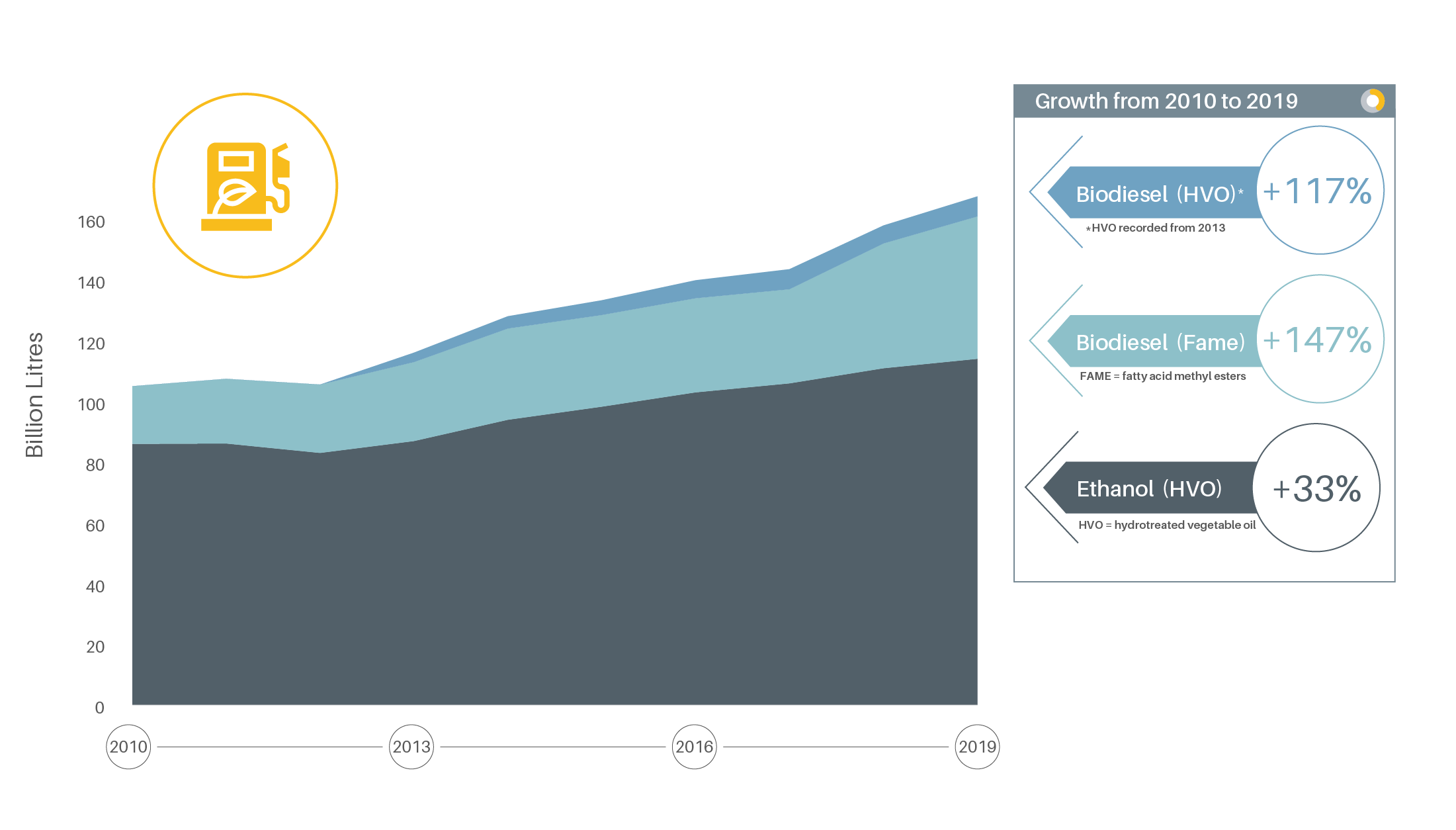

Figure 2.

Global biofuel production, 2010-2019

Aviation is among the fastest growing transport sectors; however, despite significant efforts to incorporate renewable energy in the sector, biofuels provided only around 0.01% of aviation fuel during 2019.

-

Emission trends

Heavy-duty vehicles account for three-quarters of the energy demand and carbon dioxide (CO2) emissions from freight, yet they remain the most challenging type of road vehicle to find cost-effective energy alternatives for.

-

Policy Measures

Policies to promote renewable energy in the transport sector continue to focus mainly on road transport, with rail, aviation and shipping receiving less attention despite being large energy consumers.

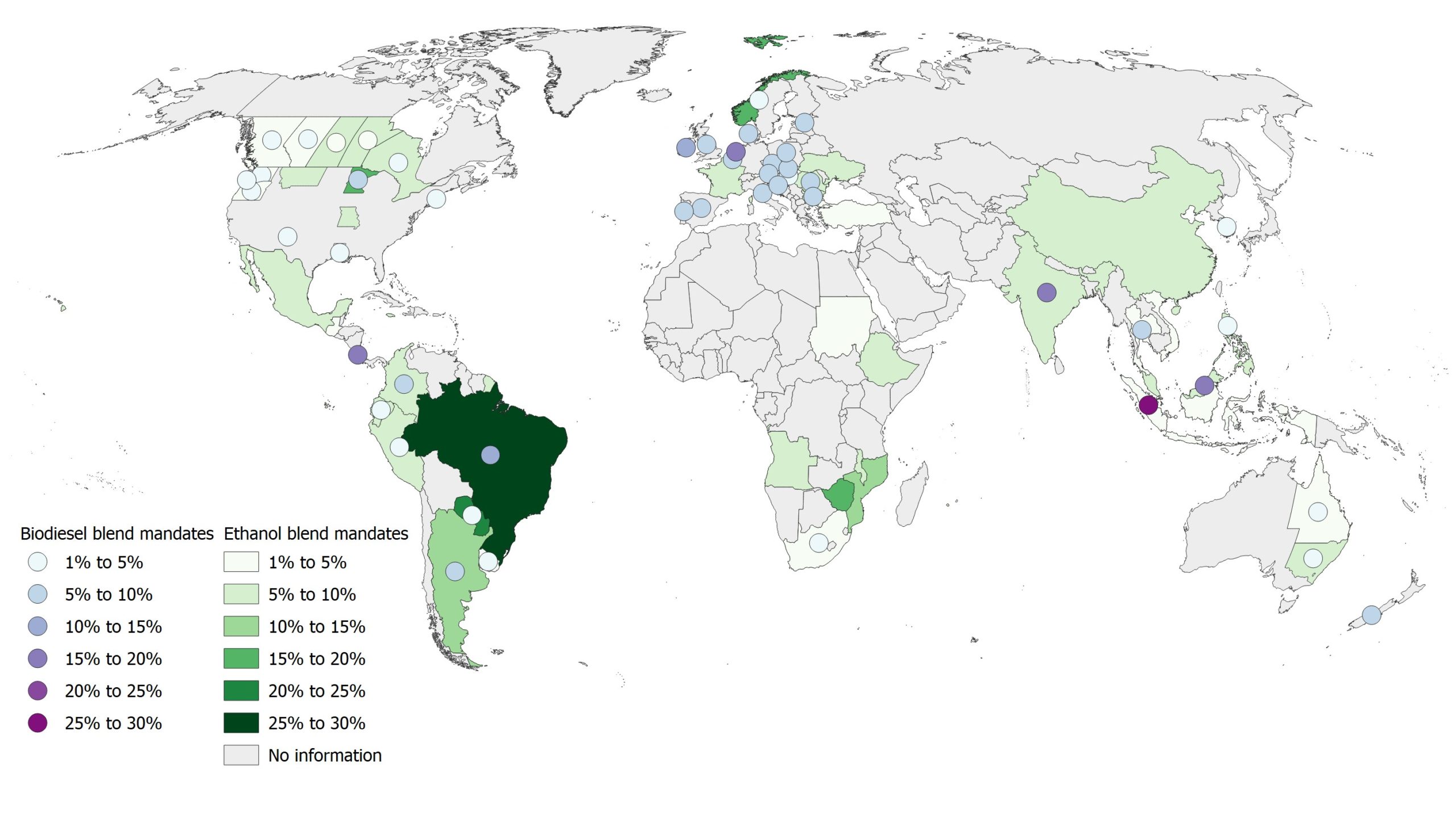

As of the end of 2019, only 46 countries had some form of renewable energy target for transport, and just 11% of countries included measures for renewables-based transport in their Nationally Determined Contributions (NDCs) towards reducing emissions under the Paris Agreement.

Biofuel blending mandates remain one of the most widely adopted policies for increasing renewable fuels in road transport; however, no new countries introduced such mandates in 2018 or 2019, with the total remaining at 70 countries.

Figure 3.

Biofuel blending mandates worldwide, by blend level, as of 2020

The maritime transport sector has scaled up efforts to incorporate renewable energy by using fuels generated from renewable sources and applying electrification and wind energy as complementary strategies.

The increasing scope of policies to electrify road vehicles and other transport modes offers significant potential to increase the share of renewable energy in transport.

-

Impacts of the COVID-19 pandemic

Due to the pandemic, oil demand was down nearly 5% in the first quarter of 2020, reflecting reduced demand for land-based transport, shipping and aviation; meanwhile, the demand for renewables grew.

Economic recovery packages offer significant potential to align renewable energy and transport policies for a green and equitable recovery, but initial plans have fallen short in this area.

Key indicators

2017*

2019*

% change

Key indicators

2017*

2019*

% change

Key indicators

2017*

2019*

% change

Key indicators

2017*

2019*

% change

Key indicators

2017*

2019*

% change

Key indicators

2017*

2019*

% change

Key indicators

2017*

2019*

% change

Key indicators

2017*

2019*

% change

Key indicators

2017*

2019*

% change

Key indicators

2017*

2019*

% change

Key indicators

2017*

2019*

% change

Key indicators

2017*

2019*

% change

Key indicators

2017*

2019*

% change

Key indicators

2017*

2019*

% change

Key indicators

2017*

2019*

% change

Key indicators

2017*

2019*

% change

Key indicators

2017*

2019*

% change

Key indicators

2017*

2019*

% change

Key indicators

2017*

2019*

% change

(*) Data are for the indicated year unless noted otherwise.

FAME = fatty acid methyl esters; HVO = hydrotreated vegetable oil; mboe/d = million barrels of oil equivalent per day