Financing Climate Action in Transport

Adequate financing is critical to reaching the scale of decarbonisation of the transport sector necessary to achieve Paris Agreement targets. There is often a lack of government capacity to design transport climate change projects that are attractive to financial institutions and the private sector. Capacity building support is essential and can be leveraged by a wide range of stakeholders.

Key Findings

- Transport investment trends

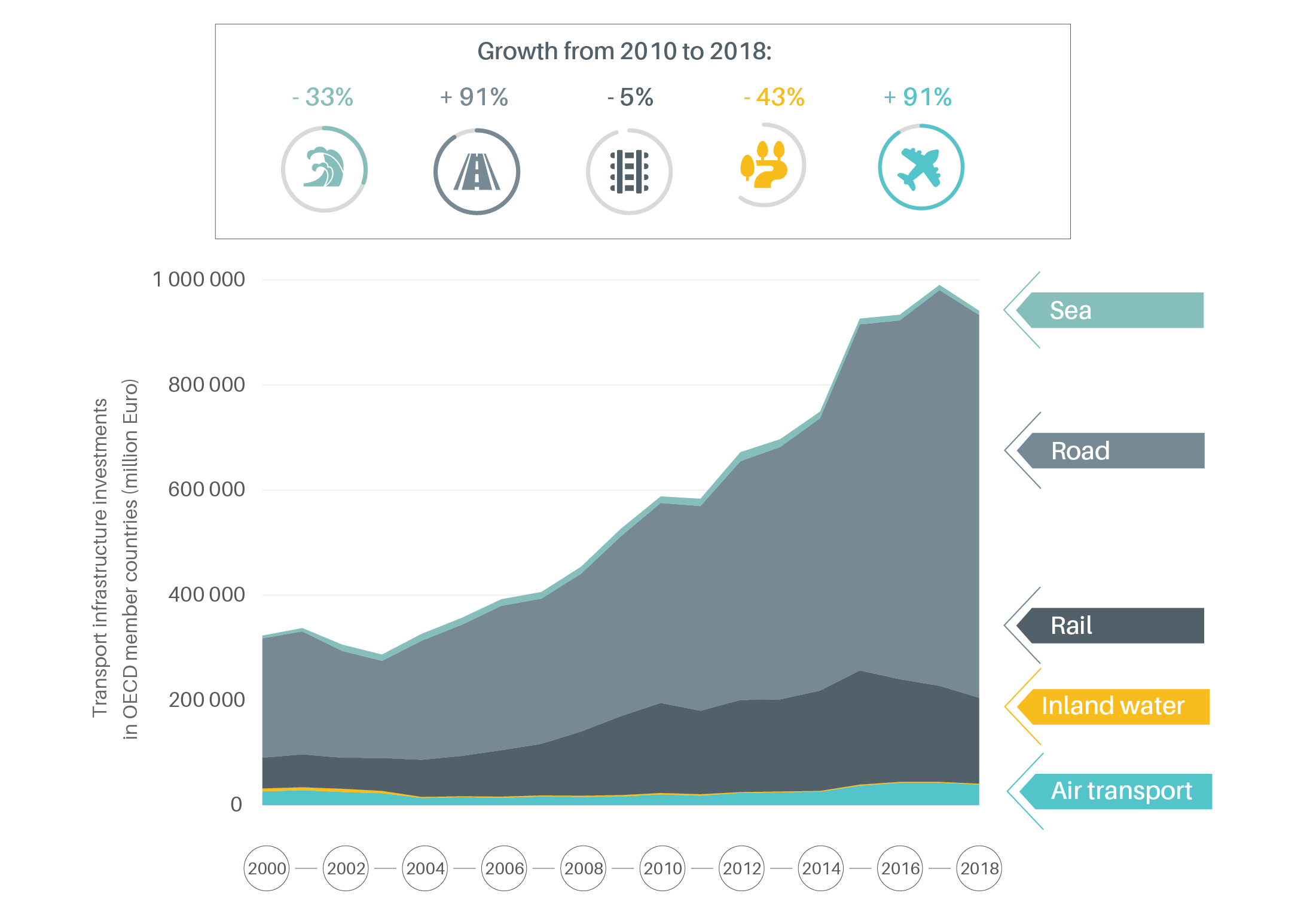

Nearly two-thirds of the investment in transport infrastructure in 2015 (USD 666 billion, or 66%) went to road transport, followed by rail (USD 231 billion; 23%) and airports and ports (around USD 55 billion, or 5%, each).

In member countries of the Organisation for Economic Co-operation and Development (OECD), transport infrastructure spending grew 7% annually on average between 2010 and 2017, before falling nearly 5% in 2018 driven by reduced investment in rail and water transport.

Figure 1.

Transport infrastructure investments in OECD countries, 2000-2018

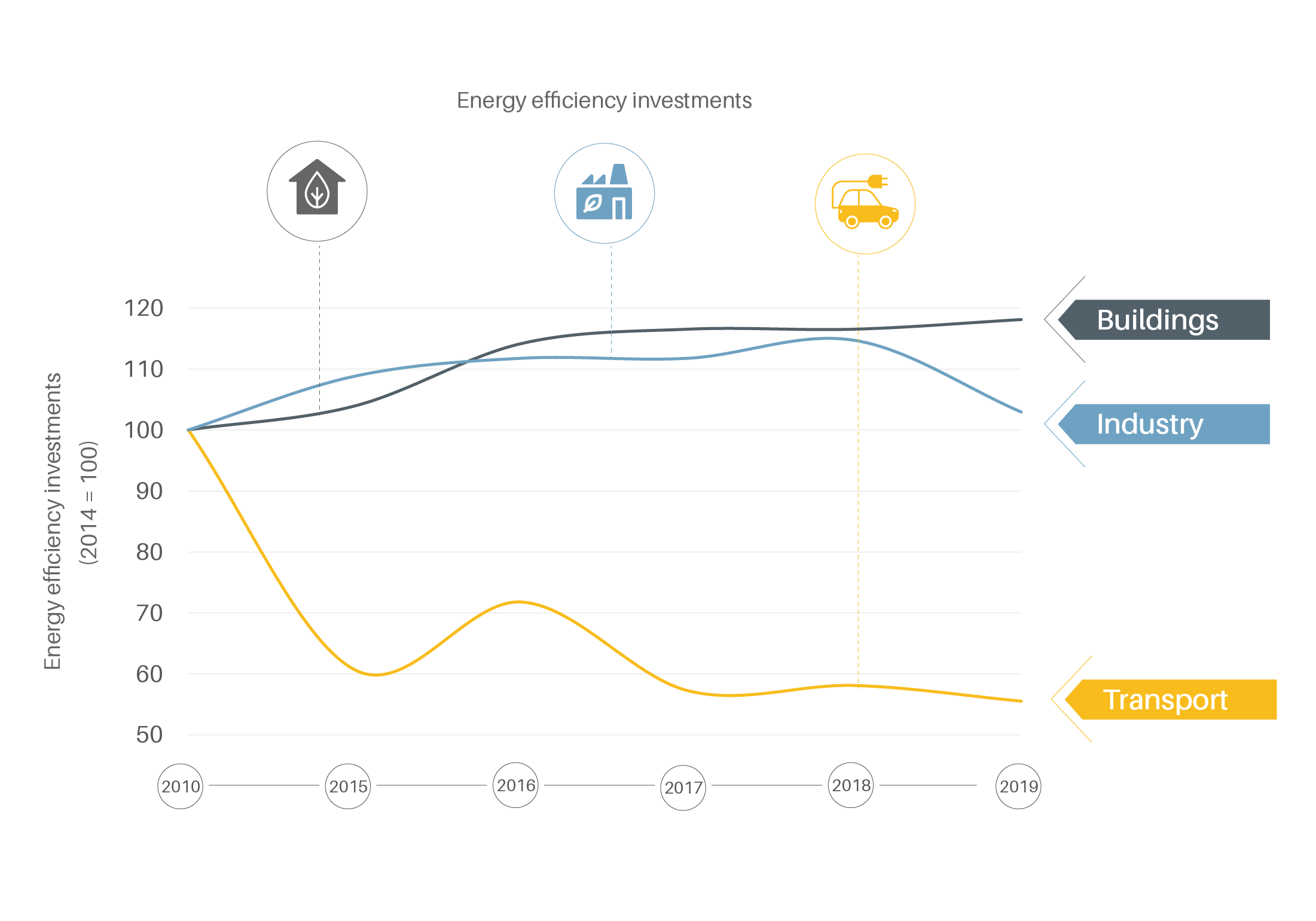

In 2019, an estimated USD 250 billion was invested in energy efficiency for buildings, industry and transport, but the transport sector received only 26% of this (USD 65 billion), and overall investment in transport has fallen dramatically since 2014.

Figure 2.

Global investment in energy efficiency by sector, 2014-2019

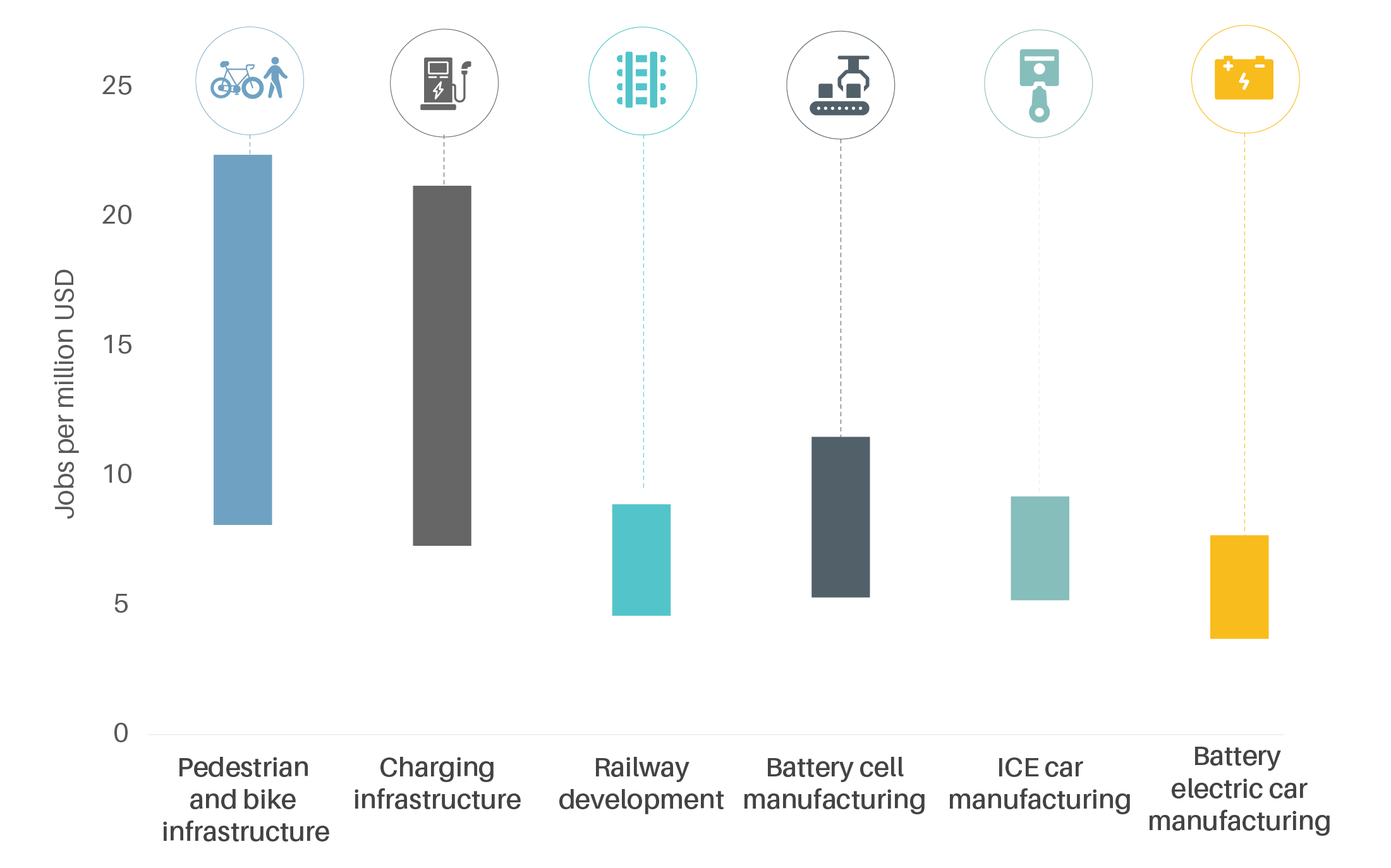

On a global basis, investments in walking and cycling infrastructure and in electric vehicle charging infrastructure hold the highest potential to multiply employment opportunities.

Figure 3.

Potential jobs created through transport investments

- Estimated transport investment needs and gaps

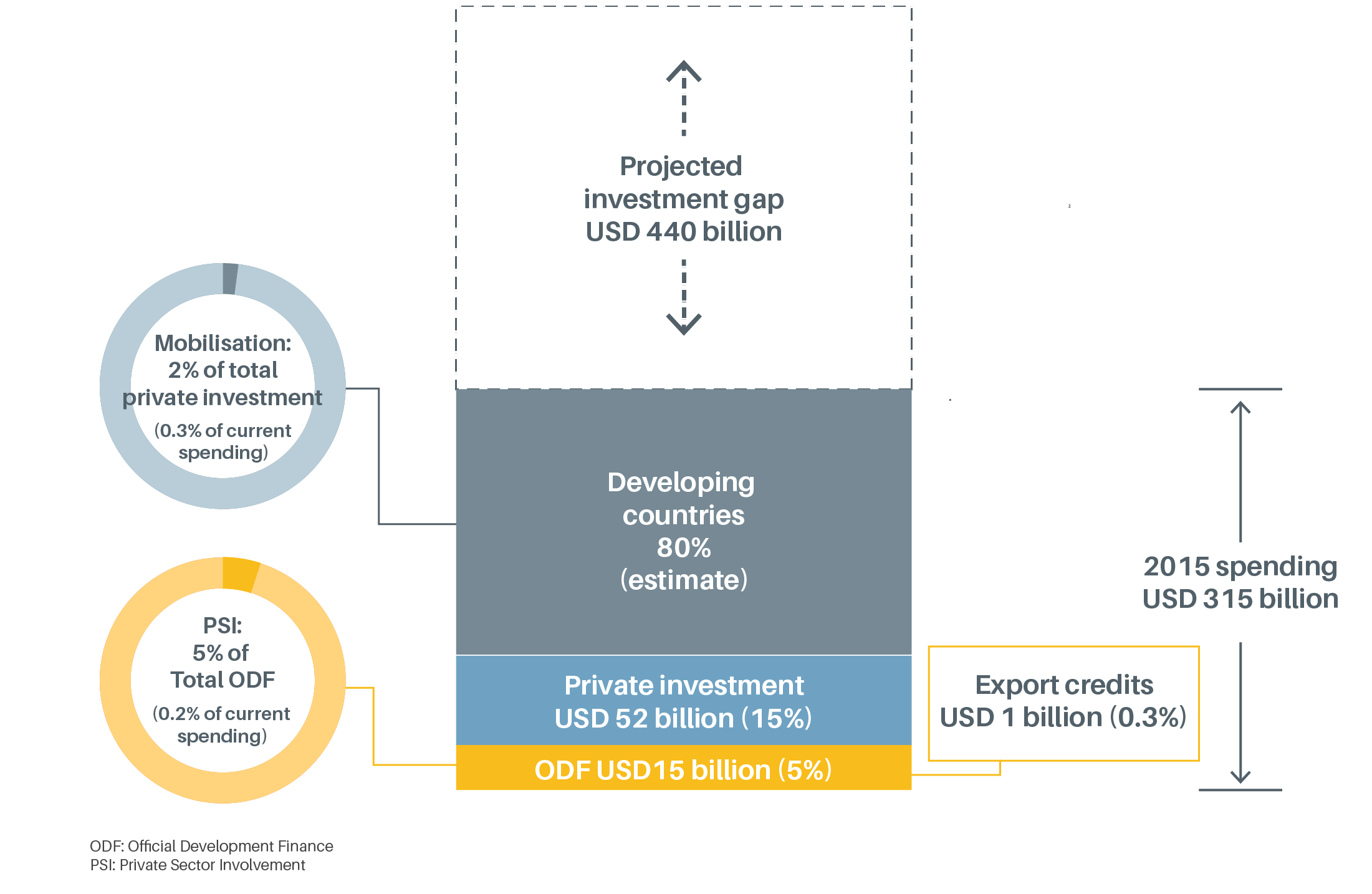

There remains an estimated annual financing gap of around USD 440 billion for transport infrastructure to meet the United Nations (UN) Sustainable Development Goals by 2030.

Figure 4.

Spending for transport connectivity by financier in 2015 and the annual investment gap to 2030

Investments required to reduce urban emissions through low carbon urban mobility are projected to total USD 1.83 trillion (around 2% of global gross domestic product, GDP) annually, which would result in savings of USD 2.80 trillion in 2030 and USD 6.98 trillion in 2050.

Globally, investments of USD 2.7 trillion per year from 2016 to 2030 (or USD 40.5 trillion in total) will be needed to achieve low carbon transport pathways, with 60-70% of these investments in emerging economies.

Regional investment gaps for transport infrastructure by 2040 are significant, estimated at USD 0.8 trillion for Africa, USD 1.6 trillion for Asia and USD 6.0 trillion for the Americas.

Globally, 88% of roadways do not meet minimum walking safety requirements, and 86% do not meet minimum cycling safety requirements. In Africa, more than 9 out of 10 streets do not meet minimum walking and cycling safety requirements.

- Sources of transport infrastructure finance

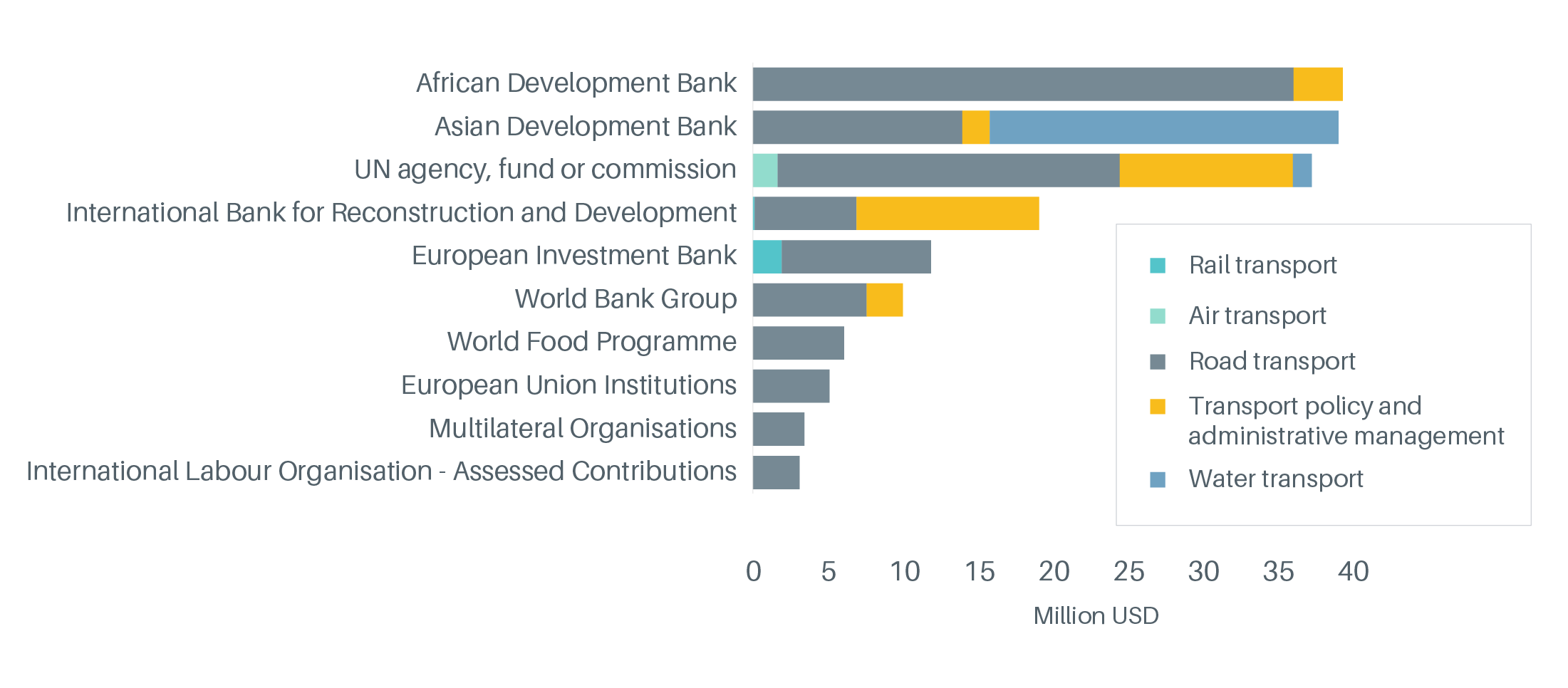

In 2019, 37% of infrastructure official development finance (including government aid to developing countries and grants/loans from multilateral financial institutions) was allocated to the transport and storage sectors, compared to 36% to energy and 20% to water and sanitation.

In 2014-2015 (latest aggregated data), 75% of official development finance for climate objectives in transport was targeted for adaptation activities (mainly port and road transport) and 25% was targeted for mitigation activities (mainly air and rail transport).

Figure 5.

Official development assistance to transport from the top 10 development partners, by sub-sector, 2019

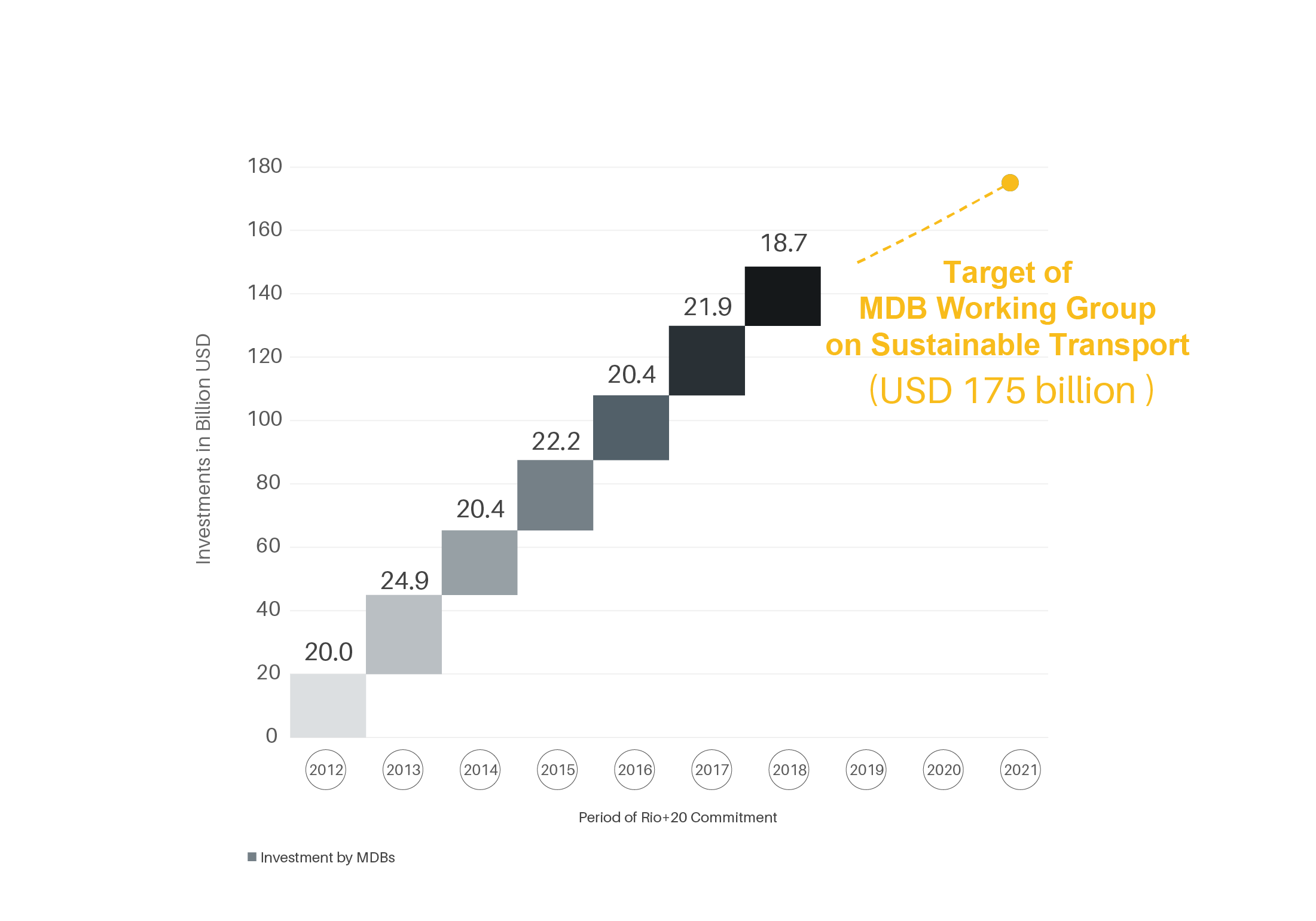

The Multilateral Development Bank (MDB) Working Group on Sustainable Transport reported nearly USD 22 billion of new funding for sustainable transport in 2017 and nearly USD 19 billion in 2018; the Working Group is on track to achieving its 2012 commitment of USD 175 billion over 10 years.

Figure 6.

Contributions by the Multilateral Development Bank Working Group on Sustainable Transport, 2012-2018

Multilateral development banks set new climate change targets in 2020, to be achieved primarily by reducing funding for fossil fuels.

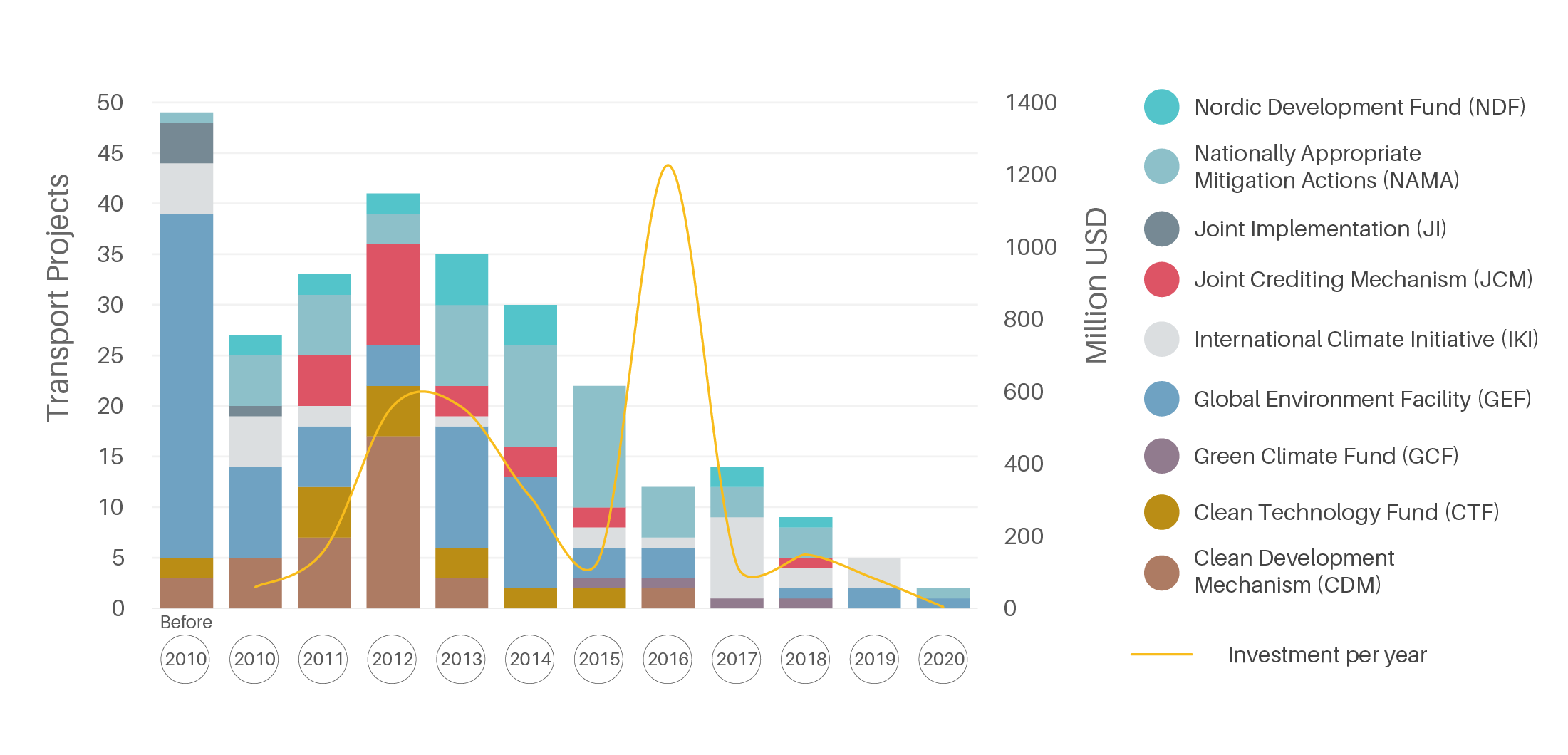

Climate finance for sustainable transport continued a downward trend since 2012, with only 16 new transport projects added to climate finance instrument pipelines between 2018 and 2020.

Figure 7.

Climate finance projects and investment volume by year

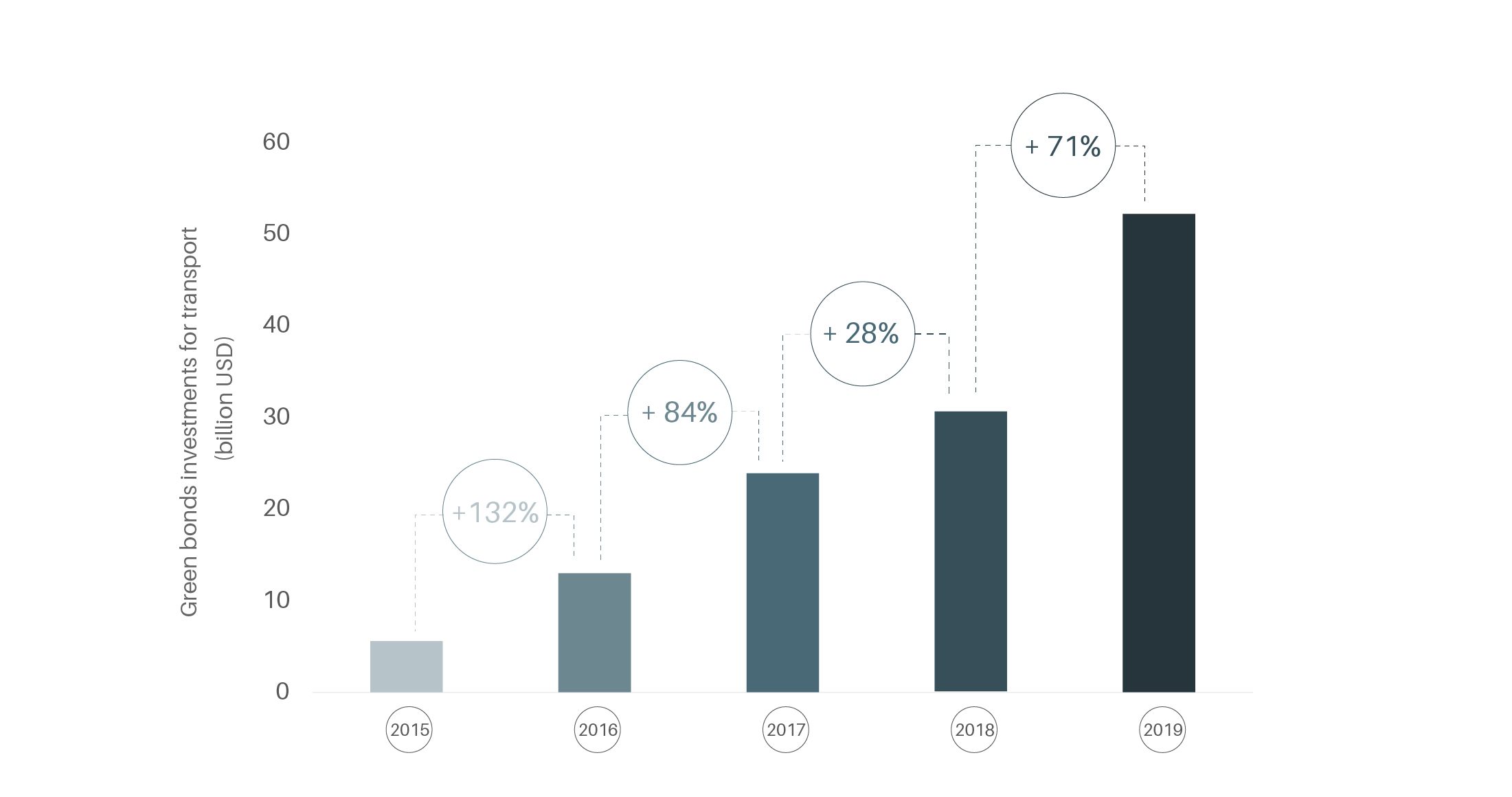

Transport represents 20% of green bond proceeds, making it the third largest sector after energy (32%) and buildings (30%). Green bonds for transport reached USD 52 billion in 2019, up 71% from 2018.

Figure 8.

Total proceeds of green bonds for transport, 2015-2019

In December 2020, Climate Bonds updated the transport criteria for green bonds to reflect a stricter threshold for passenger transport.

The COVID-19 pandemic led to a low-yield environment in 2020, making transport infrastructure assets even more attractive to investors by offering predictable cash flows as well as consistent and reasonable returns.

- Transport pricing mechanisms and subsidies

In 2020, around 16% of global greenhouse gas emissions were covered by a carbon pricing mechanism (up from 5% in 2010). However, transport remains largely marginalised in discussions of carbon pricing and emission trading schemes, with few exceptions.

Global energy subsidies reached an estimated USD 5.2 trillion (6.5% of GDP) in 2017. Despite repeated pledges to end subsidies, support for fossil fuels among G20 governments has declined only 9% since 2014-2016, totalling USD 584 billion annually during 2017-2020.

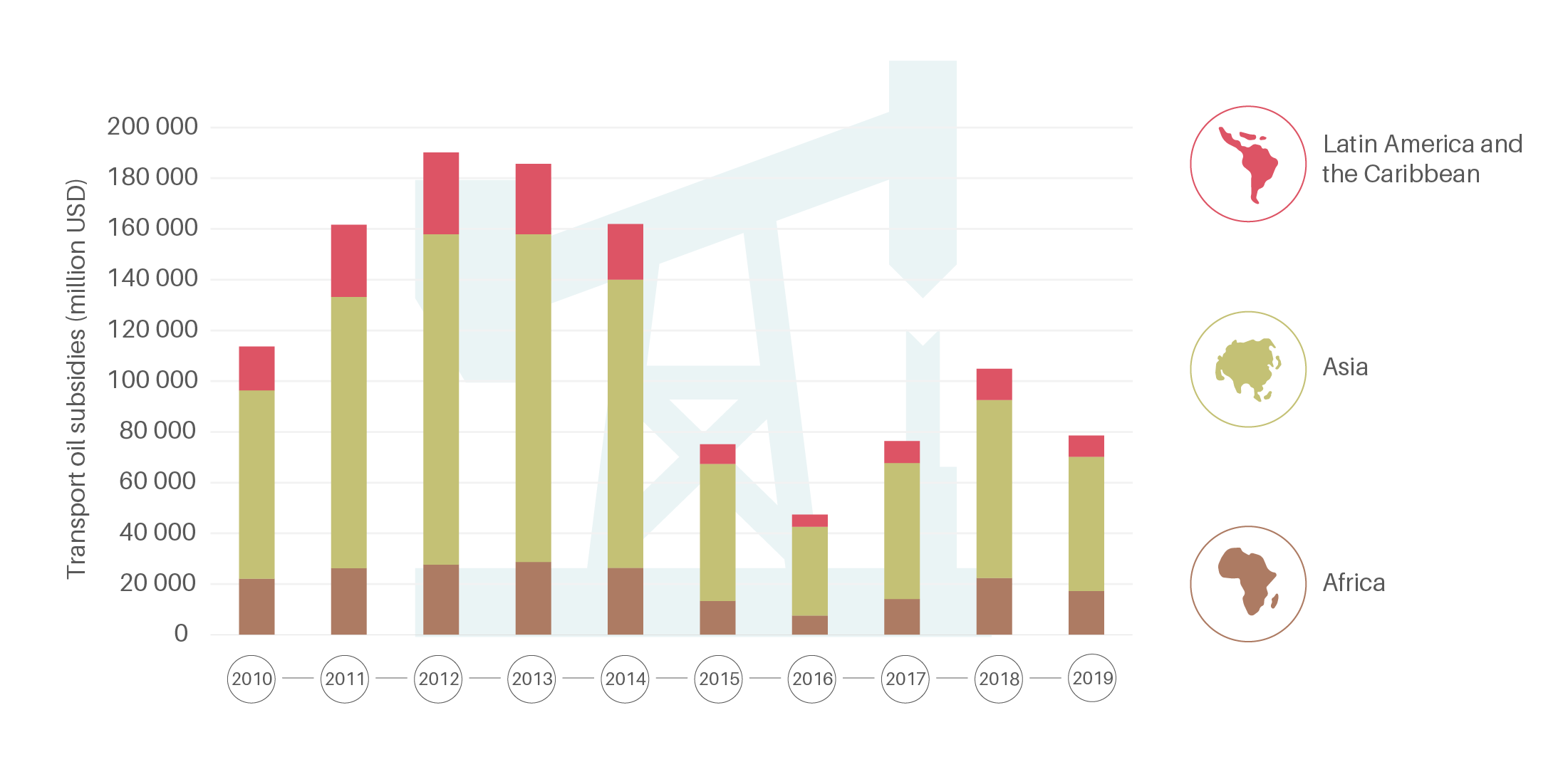

Figure 9.

Transport oil subsidies, 2010-2019

Between 2015 and 2018, 50 countries enacted fossil fuel subsidy reforms focused on either consumption or production, or a combination of the two. Despite these and other efforts, global consumer subsidies for fossil fuels increased slightly in 2017.

- COVID-19 pandemic recovery investment commitments

Current COVID-19 recovery packages dwarf existing low carbon investments; only a fraction of the investment in these packages could put the world on track towards decarbonisation by 2050.

Within recovery packages, only around a third of transport investments are associated with clean transport, which are outweighed by fossil fuel-focused investments.

G20 countries have committed more than half of total tracked stimulus spending to transport projects (USD 276 of USD 506 billion as of December 2020), but only around one-third of this transport spending (USD 103 billion) targets green transport improvements.

In September 2020, the mayors of 12 major cities (Berlin, Bristol, Cape Town, Durban, London, Los Angeles, Milan, New Orleans, New York City, Oslo, Pittsburgh and Vancouver) committed to divesting funding from fossil fuel companies and to shifting to a green and just recovery from COVID-19 and to tackling climate change (although the target dates were unspecified).