-

Financing Sustainable Transport in Times of Limited Budgets

- Key Findings

- Effective financing is crucial for the development of modern transport networks that facilitate economic growth, improve connectivity and enhance quality of life for residents. It involves a combination of public and private resources, strategic planning and careful allocation of funds to ensure the efficient operation and expansion of transport infrastructure and services.

Current investment and financing for transport infrastructure

- Transport is the largest recipient of infrastructure investment among sectors globally, attracting an estimated USD 79 trillion from 2015 to 2040; of this, USD 26 trillion (one-third) goes to roads and USD 10 trillion to rail.

- The global market for transport services reached USD 7.3 trillion in 2022 and is projected to more than double to USD 15.9 trillion by 2032.

- Many countries have placed an emphasis on expanding the capital stock in the transport sector, and in particular on expanding highway networks, with the aim of improving connectivity and supporting economic development.

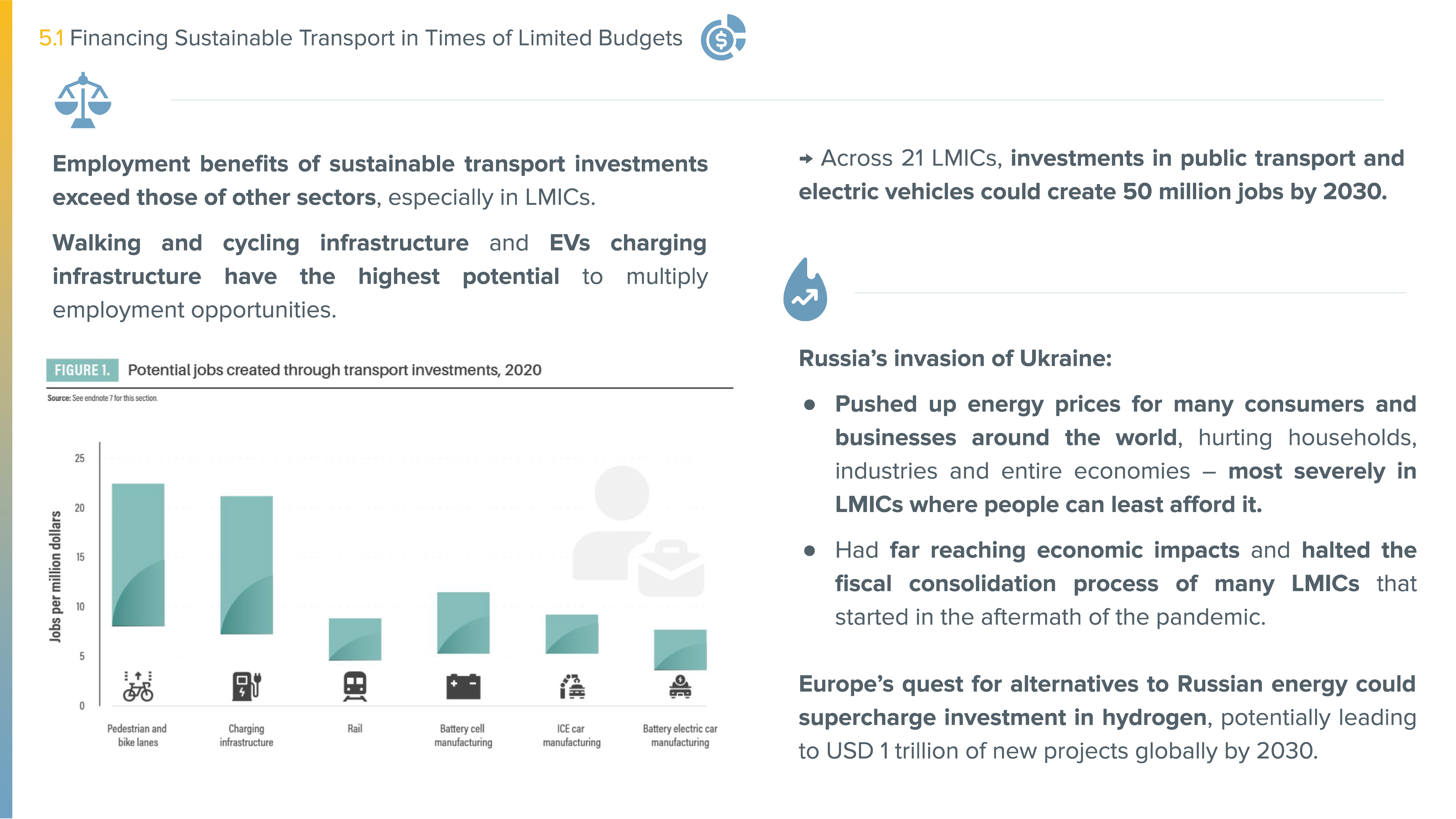

- The employment benefits of sustainable transport investments exceed those of other sectors (including building retrofits and solar/wind power conversion) and can be especially high in low- and middle-income regions. Globally, the transport investments with the highest potential to multiply employment opportunities are in walking and cycling infrastructure and in electric vehicle charging infrastructure.

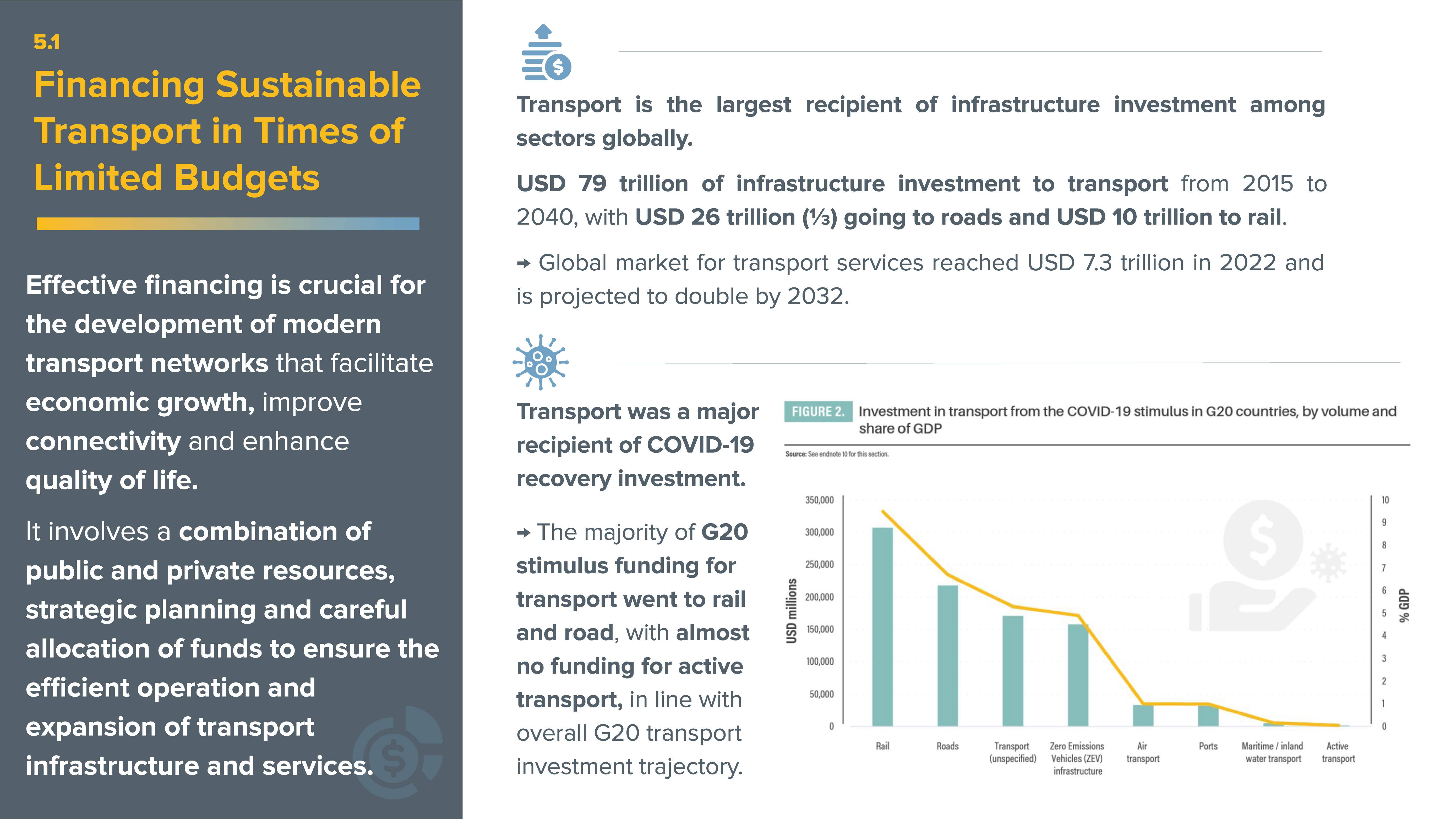

- Transport was a major recipient of COVID-19 recovery investment. In the G20 countries, the majority of the stimulus funding for transport went to the rail and road sectors, with almost no funding for active transport; this is in line with overall G20 transport investment in recent years.

Impacts of the Russian invasion of Ukraine

- The Russian Federation’s invasion of Ukraine pushed up energy prices for many consumers and businesses around the world, hurting households, industries and entire economies – most severely in low- and middle-income countries where people can least afford it.

- The war in Ukraine has had far reaching economic impacts and has halted the fiscal consolidation process of many low- and middle-income countries that started in the aftermath of the pandemic.

- Europe’s quest for alternatives to Russian energy could supercharge investment in hydrogen, potentially leading to USD 1 trillion of new projects globally by 2030.

Major trends in transport financing

-

The transport sector has dominated infrastructure investments in both the G20 countries and in the member countries of the Organisation for Economic Co-operation and Development (OECD). However, much of this investment has been for road construction and highway expansion, supporting rising motorisation rates while not necessarily enhancing travel opportunities and conditions.

- In 2022, around 42% of public funding in the G20 countries went to transport sector investments, of which nearly half (46%) were in road transport, followed by rail and public transport.

- The transport sector also represented a large share of spending in China and in some low- and middle-income countries. China spent 5.6% of its gross domestic product (GDP) on transport in 2022, compared with shares of only around 0.7% to 0.9% each in Denmark, France, Germany, Mexico, the Russian Federation and the United Kingdom.

Finance for transport decarbonisation

- Achieving the needed reductions in greenhouse gas emissions from transport will require strong regulations and fiscal incentives as well as large investments in infrastructure to enable low- and zero-emission transport.

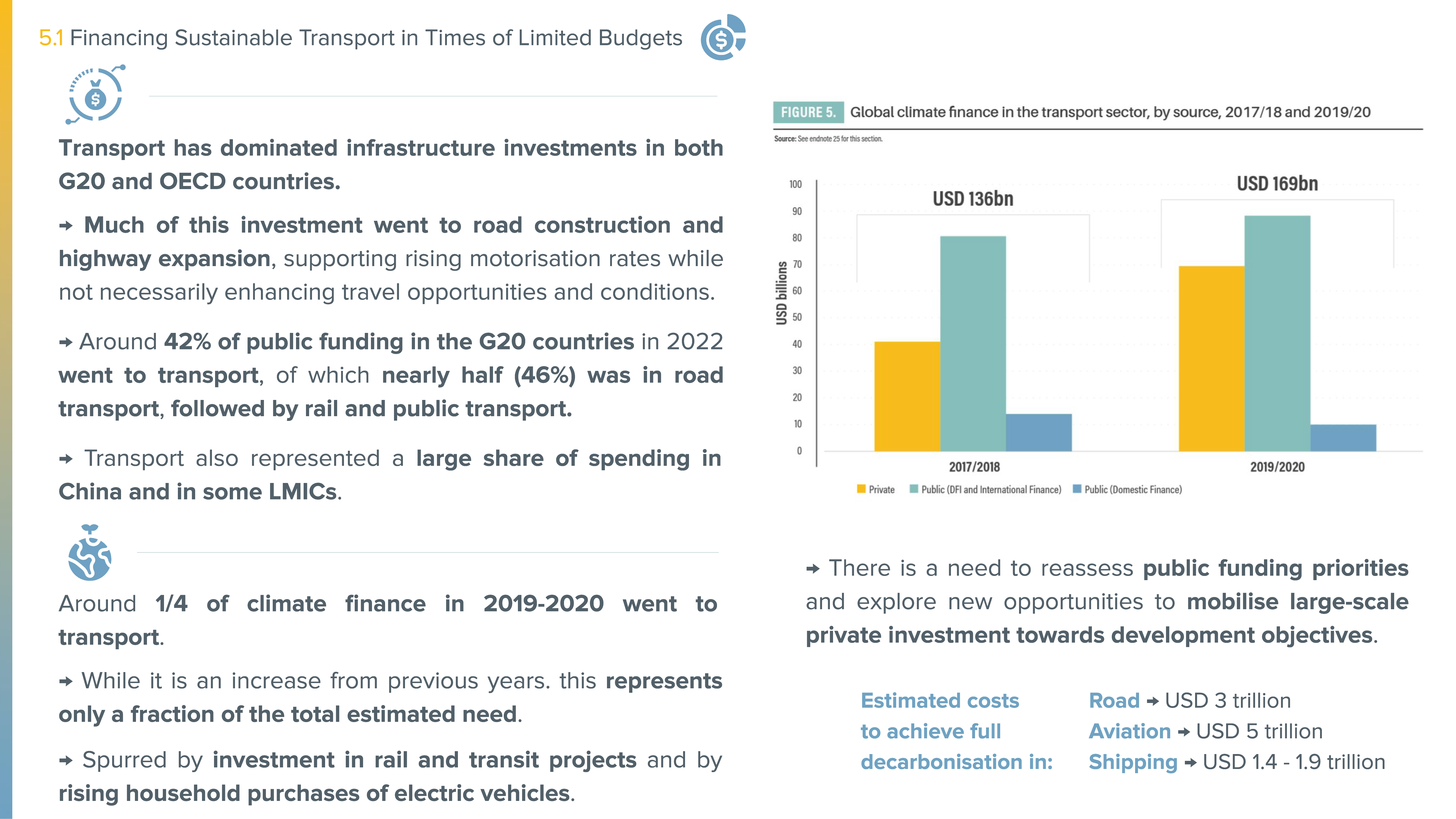

- Climate finance totalled USD 653 billion in 2019/20, with around a quarter of it (USD 169 billion) going to the transport sector. This was more than in previous years – spurred by investment in rail and transit projects and by rising household purchases of electric vehicles – but represents only a fraction of the total estimated need.

- Despite significant pledges to increase multilateral financing through various low-carbon mechanisms, only a small share of these funds cover transport decarbonisation projects. Addressing this gap requires reassessing public sector funding priorities and exploring new opportunities to mobilise large-scale private investment towards development objectives.

- Public money was consistently the main source of financing for climate change mitigation and adaptation actions in the transport sector from 2017 to 2020.

- Of the green bond volume in 2022, two-thirds (67%) originated in developed markets, with the rest coming from emerging markets (23%) and from supranational issuers such as the World Bank and Asian Development Bank (9%).

- The EU’s extensive green bond programme has driven much of the growth in green bonds, issuing a cumulative USD 39.9 billion over four deals since its debut in October 2021.

- Collectively, green bonds for energy, buildings and transport accounted for 77% of the total green debt volume in 2022 (down from 81% in 2021 and a high of 85% in 2021), with transport contributing just under USD 100 billion.

- Countries raised a record USD 95 billion in 2022 through carbon pricing schemes that charge firms for emitting carbon dioxide, covering around 23% of global greenhouse gas emissions.

- In the transport sector, progress in carbon financing is mixed. Most carbon markets have focused on aviation and maritime emissions and less on emissions from land-based transport. In road transport, 99% of the carbon price signal resulted from fuel taxes, not carbon pricing initiatives.

- Consumer and government spending on electric cars increased 50% in 2022 to reach USD 425 billion globally.

-

As the electric car market matures, reliance on direct subsidies is expected to phase out over time. The focus of government policy incentives is gradually shifting from consumers to charging infrastructure and battery manufacturing, leading to announcements of record investments in new battery manufacturing capacity in 2022.

- The transport sector relied on fossil fuels for nearly 96% of its energy consumption in 2020 and 2021. In the transport sector alone, subsidies and other support for fossil fuels jumped 31% in 2021 due to the surge in fuel use following the lifting of COVID-related mobility restrictions.

- Despite a slump in revenues, auto companies maintained strong spending on research and development in 2020 and 2021, in a push to gain a technological edge in the fast-changing mobility sector. In 2021, low-carbon mobility and battery start-ups accounted for a combined 35% of the spending growth and for 40% of the early-stage finance.

Projected transport investment needs

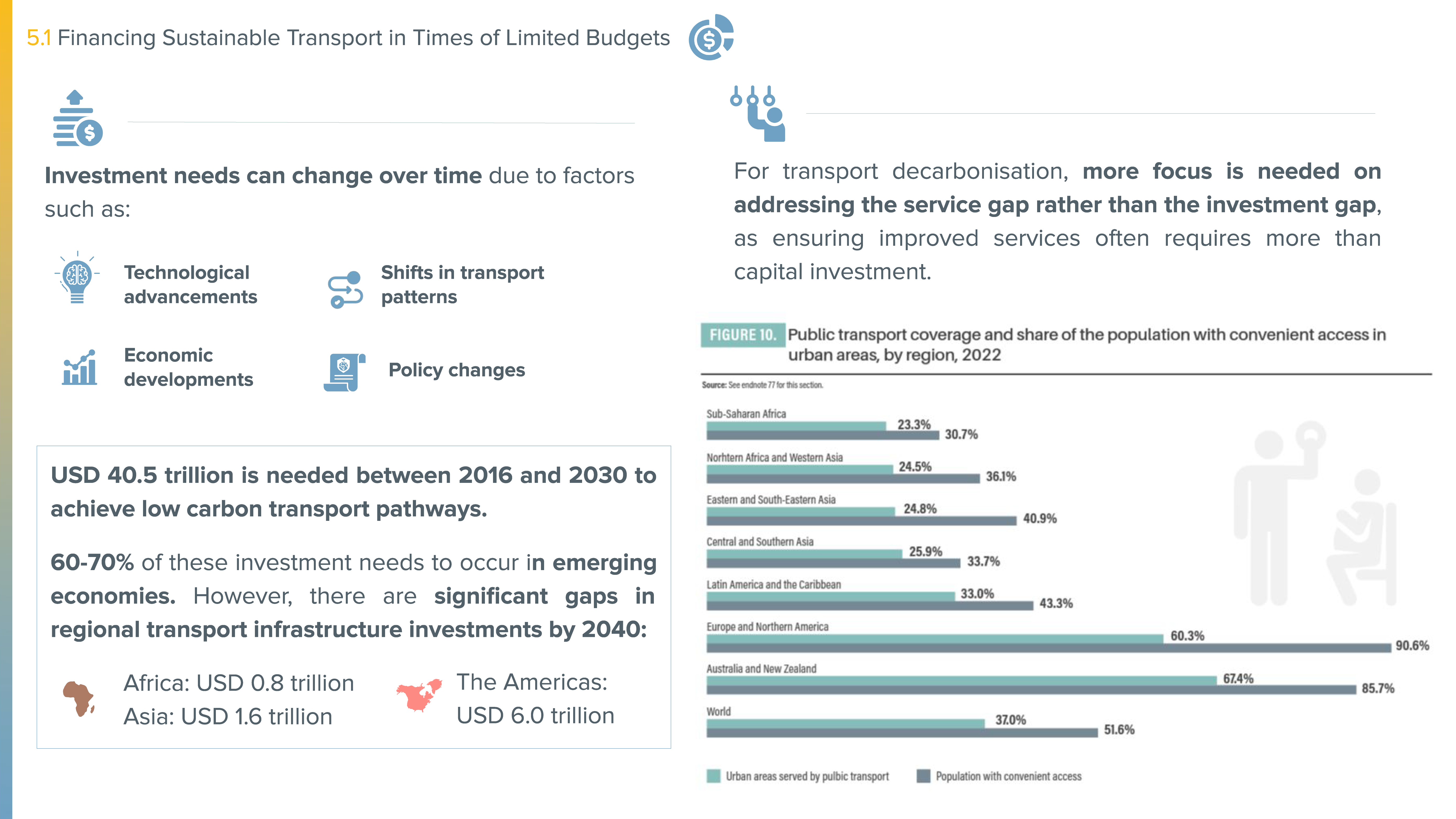

- Investment needs can change over time due to factors such as technological advancements, shifts in transport patterns, economic developments and policy changes. For transport sector decarbonisation, more focus is needed on addressing the service gap rather than the investment gap, as ensuring improved services often requires more than capital investment.

- An estimated USD 2.7 trillion in annual investment (USD 40.5 trillion in total) will be needed globally between 2016 and 2030 to achieve low carbon transport pathways, with 60-70% of the investment occurring in emerging economies. However, regional investment gaps for transport infrastructure by 2040 are significant, estimated at USD 0.8 trillion for Africa, USD 1.6 trillion for Asia and USD 6.0 trillion for the Americas.

- Global investment needs for transport infrastructure through 2050 are an estimated USD 50 trillion. Reducing emissions through low carbon urban mobility would require investments totalling USD 1.83 trillion (around 2% of global GDP), which would result in estimated savings of USD 2.8 trillion in 2030 and nearly USD 7.0 trillion in 2050.

Author: Jyoti Bisbey, World Association of PPP Units and PPP Professionals