-

Vehicle Technologies

- Key Findings

Demand trends

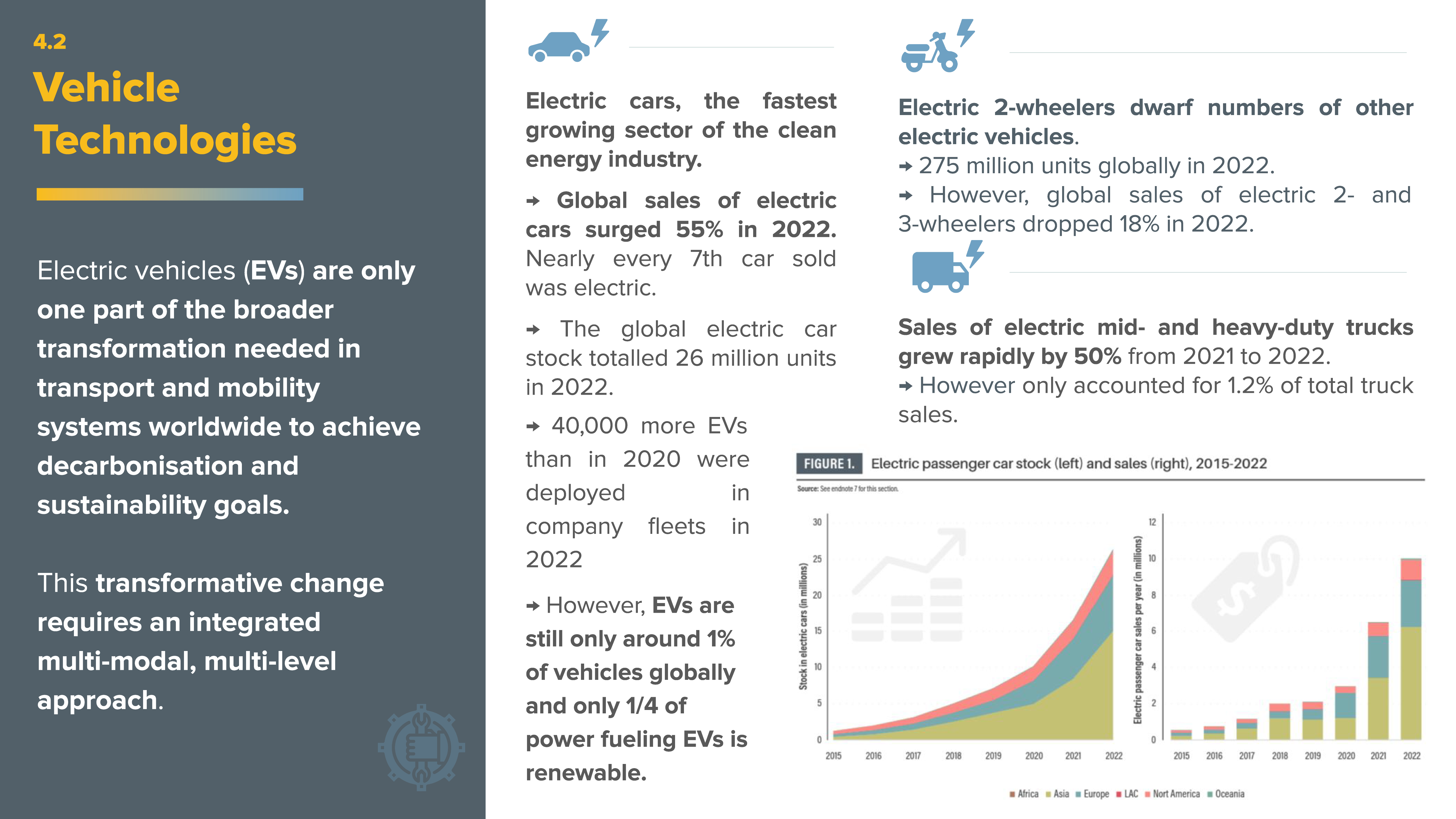

- Electric four-wheeled vehicles are the fastest growing sector of the clean energy industry. In 2022, global sales of electric cars (including battery electric vehicles and plug-in hybrid electric vehicles) increased 55% – exceeding 10 million units – and nearly every seventh car sold was electric.

- The global electric car fleet increased 154% between 2020 and 2022, maintaining five-year average growth of 53%. The global electric car stock totalled 26 million units in 2022, more than five times the number in 2018. However, electric vehicles still accounted for only around 1% of vehicles globally. In 2022, an estimated 70% of the fleet was battery electric vehicles, and 30% was plug-in hybrids.

- As of 2022, at least 209,000 electric vehicles were deployed in company fleets, around 40,000 more than at the end of 2020.

- Electric two-wheeled vehicles (i.e., electric-assist bikes, mopeds and non-speed-limited motorcycles) dwarf numbers of other electric vehicles, with a total of 275 million units globally in 2022. However, global sales of electric two- and three-wheeled vehicles fell 18% in 2022, from more than 11 million units in 2021 to 9.2 million units. Most sales were in Asia, with China accounting for around 84% of new electric two-wheeled vehicle registrations in 2022.

- The number of electric medium- and heavy-duty trucks increased 19% in 2022 to 322,000 vehicles. Sales of electric trucks increased from 40,000 units in 2021 to around 60,000 units in 2022, although this reflected just 1.2% of total truck sales.

- The global electric van stock grew 45% in 2022, to an estimated 948,000 vehicles, and the electric bus fleet grew 8% to 800,000 vehicles. Electric bus sales represent 4.5% of total new bus sales in 2022.

- Global sales of used electric vehicles have increased, with the European Union (EU), Japan and the Republic of Korea exporting more than 760,000 units between 2017 and 2020.

- Electric vehicle charging infrastructure grew 55% in 2022. An estimated 900,000 new publicly available chargers were installed worldwide during the year, bringing the cumulative total to 2.7 million.

-

In 2022 – and for the first time since 2013 – average global prices for electric vehicle batteries rose 7% due to higher material and energy costs during production, a trend that could slow the global uptake of e-mobility solutions.

- Electric vehicle battery swapping systems have continued to grow globally. In 2021, the market was dominated by services catering to passenger electric vehicles, accounting for an estimated 57.5% of the total revenue and led by the increase in electric micro-mobility, such as e-scooters.

- A major driver of future demand for electric vehicles is lower fuel costs, which were at least a third those of diesel and petrol in 2022.

Emission trends

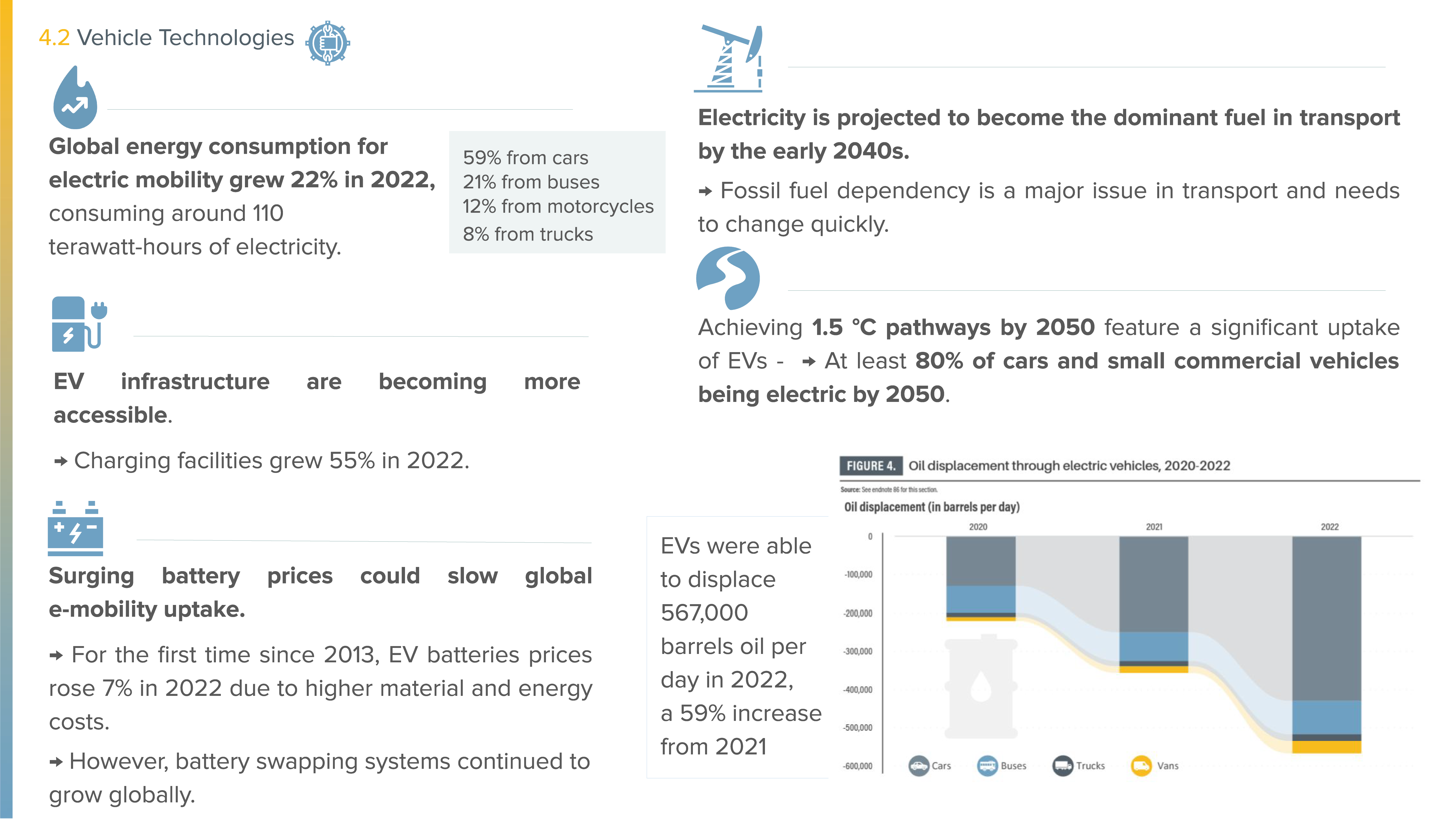

- Global energy consumption for electric mobility increased 22% in 2022, with more than half (59%) of the demand coming from electric cars, followed by electric buses (21%), motorcycles (12%) and trucks (8%). In total, these electric vehicle fleets consumed around 110 terawatt-hours of electricity in 2022.

- Fossil fuel dependency is a major issue in transport and needs to change quickly. Electricity is projected to become the dominant fuel in transport by the early 2040s.

- Aggressive emission reduction pathways aligned with the goal of keeping global warming below 1.5 degrees Celsius (°C) by 2050 feature a significant uptake of electric vehicles, with at least 80% of cars and small commercial vehicles being electric by 2050.

- Although the Russian Federation’s invasion of Ukraine led to surging natural gas prices and greater demand for coal, the increased carbon dioxide (CO2) emissions from coal have been curtailed by the more aggressive deployment of renewable energy technologies (such as solar photovoltaics and wind) and of electric vehicles.

- Overall, battery electric vehicles emit fewer life-cycle greenhouse gas emissions than fossil fuel-powered vehicles, especially when the vehicles are charged using low-carbon electricity.

Policy developments

- Electric vehicles are only one part of the broader transformation needed in transport and mobility systems worldwide to achieve both decarbonisation and sustainability goals, such as access to transport for all, safer roads, cleaner air and livable cities. This transformative change requires an integrated multi-modal, multi-level approach that addresses all aspects of the transport and mobility system.

- Electric vehicle uptake should be framed in a circular economy approach, including the end-of life recycling of batteries as well as the re-use and recovery of other materials (e.g., electronics, metals, minerals).

- More jurisdictions are setting targets for phasing out fossil-fuelled vehicles. As of April 2023, at least 41 countries or sub-national jurisdictions had set phase-out targets for vehicles with internal combustion engines, twice as many as in 2020.

- Many policies related to transport and climate change have highlighted the electrification of buses and/or the procurement of new e-buses, with at least 20 countries announcing such measures during 2020-2022.

-

Some governments and other stakeholders have set concrete targets for electric vehicle charging infrastructure.

- Government subsidies for electric vehicles nearly doubled in 2021, approaching USD 30 billion globally. Other economic instruments used to support uptake include tax rebates, feebates and bonus-malus schemes, in which governments incentivise zero- and low-emission vehicles while discouraging high-emission vehicles.

- By the end of 2022, countries’ climate strategies were highly favouring electric mobility over other types of actions to mitigate transport emissions.

- In 2021 and 2022, significant global initiatives were focused on the electrification of light-duty as well as medium- to heavy-duty vehicles, covering all major automobile markets and regions.

- Leading automakers are projected to spend an estimated USD 1.2 trillion to 2030 to deliver up to 54 million electric vehicles (and the necessary batteries), accounting for 50% of total vehicle production.

- There is a risk of an electric mobility divide between high-income countries and low- and middle-income countries, in the absence of electrification policies tailored at the economic and regional context.

Authors: Oliver Lah, Alvin Mejia and Kanya Pranawengkapti, Urban Electric Mobility Initiative, Wuppertal Institute

Contributor: Nikola Medimorec, SLOCAT Secretariat