-

App-Driven Shared Transport

- Key Findings

- While there is no broadly accepted definition of app-driven shared mobility, the term generally encompasses a set of business models in which mobility assets are shared among multiple users, facilitated by smartphone apps.

- Some of the most visible deployments of app-driven shared mobility have been led by private sector companies. However, public and non-profit organisations also play an important role in regulating, contracting and/or directly operating these services.

Demand trends

- Carsharing had an estimated 86 million users worldwide as of 2021, and the market is expected to reach 224 million users by 2026. The number of cities offering carsharing services increased from 3,128 in 2019 to 4,100 in 2021.

- In 2022, transport network companies – or companies that provide on-demand transport services, often through apps – had an estimated 1.28 billion users worldwide, and this number is projected to reach 1.45 billion by 2027. Although the market is dominated by cars, around a quarter of the revenues of transport network companies worldwide come from motorcycles.

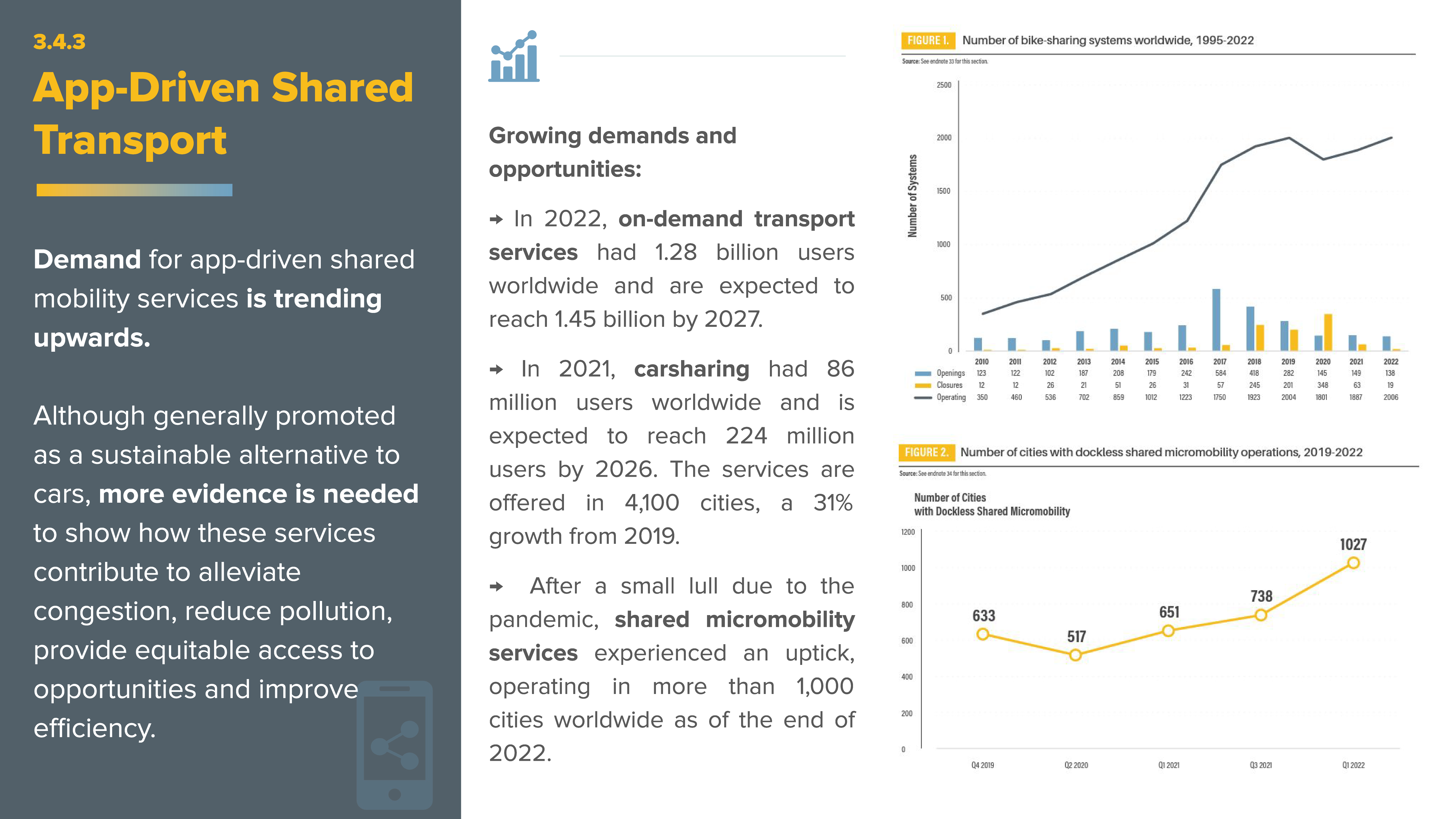

- After a small lull due to the COVID-19 pandemic, the market for shared micromobility (the use of smaller vehicles such as bikes, scooters and mopeds) experienced an uptick, with these services operating in more than 1,000 cities worldwide.

- Due to the diversity of business models, it is difficult to identify the market size of mobility-as-a-service (MaaS); however, some analysts expect continued growth in this space through 2030.

Emission trends

- Because of the diverse nature of the assets and services within app-driven shared mobility, assessing their impact on sustainability, and specifically on carbon dioxide (CO2) emissions, is difficult. Estimating the overall emission-reduction potential of app-driven shared mobility is challenging, as analyses often focus only on individual services and fail to account for a combined effect.

- Carsharing can reduce CO2 emissions 3-18%, according to the latest modelling. Interest in pairing electric vehicles with carsharing programmes is rising. As more programmes offer electrified options, the potential to mitigate CO2 emissions will likely increase.

- Ride-hailing is similarly marketed as an alternative to car ownership, and here too the evidence regarding the emission impacts is varied.

- The impacts on CO2 emissions of shared micromobility are highly dependent on the transport modes being substituted, as well as on vehicle durability and operational procedures.

- While mobility-as-a-service can in theory reduce CO2 emissions, pollution, and congestion, empirical evidence is very limited. And comprehensive studies are needed.

Policy developments

-

The deployment of peer-to-peer carsharing services has introduced regulatory challenges for governments.

- Ride-hailing operations are now common throughout the world, including in places with diverse regulatory environments – from welcoming to hostile.

- Many European cities have started to deploy stricter regulations for shared e-scooters.

- Commercial deployments of mobility-as-a-service remain limited, but developments in Europe, China and the United States might provide insights into new forms of public-private collaboration.

Author: Sebastian Castellanos, NUMO

Supporting Author: Agustina Krapp, SLOCAT Secretariat