-

The Role of Business in Decarbonising Transport

- Key Findings

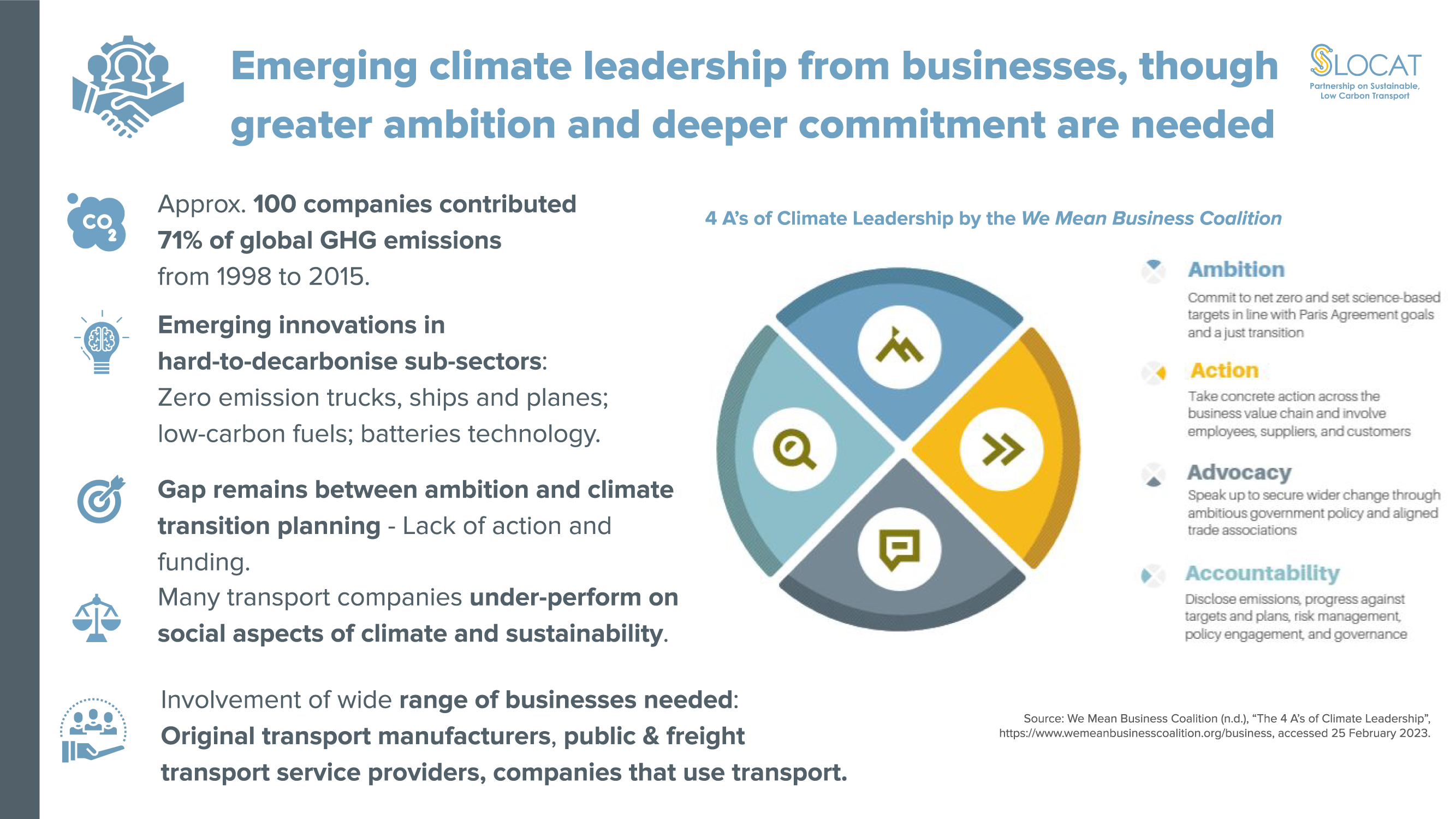

- To decarbonise transport, various types of businesses need to be involved, including transport manufacturers, public and freight transport service providers, and companies that use transport.

- Although businesses are demonstrating increasing climate leadership, collectively this remains insufficient to achieve a pathway consistent with limiting global temperature rise to below 1.5 degrees Celsius (°C).

Ambition

- While the climate ambition of transport manufacturers is increasing, targets are not enough to achieve a 1.5°C pathway.

- Transport-specific targets mostly focus on zero-emission vehicles, charging infrastructure, and renewable energy for shipping and aviation. Very few companies have set targets across all their business areas and markets and have committed to phasing out fossil fuels.

- A majority of transport companies have set goals and targets for reducing greenhouse gas emissions, but ambition must be raised. As of 2022, more than 58 countries and one-fifth of the world’s largest companies had committed to reaching carbon neutrality.

- Transport companies need to commit to phasing out fossil fuels, as the transport sector relies on oil-derived products for over 90% of its energy, more than any other sector.

- Over 2,400 companies covering more than a third of the global economy’s market capitalisation – including 43 transport manufacturers and 124 transport service providers – have approved science-based targets for reducing emissions.

Action

- Transport manufacturers have made significant progress on electric road vehicles, alternative fuels for ships and airplanes, and digital solutions.

- To reach the 1.5°C target, the global automotive sector needs to increase annual production of zero-emission vehicles to 52% of total vehicle production in 2029.

- Innovation has occurred in hard-to-decarbonise sub-sectors, such as zero-emission trucks, ships and planes; low-carbon fuels; batteries and other technologies; and infrastructure. While policy has played a role, manufacturers also have responded to customer demand and collaborated with suppliers of infrastructure, fuel and batteries, and other technologies.

- A gap remains between transport companies’ ambitions and the quality of their climate transition planning, with vast potential for improved action. Many companies may not have determined actions or allocated funding to meet their targets.

- Globally, transport companies under-perform on the social aspects of climate and sustainability, including human rights, just transition, decent work and ethical conduct, even though these are critical for the successful implementation of a climate transition plan.

- Companies have taken actions related to their own fleets, including electric vehicles, biking and working from home.

- Shippers hold the key to making structural changes to freight transport by shifting to low-carbon modes and reducing demand.

- Many companies have shown greater advancement in general energy-related measures than in tackling transport.

Advocacy

- Businesses have been more supportive of infrastructure and incentives for alternative fuels and zero emissions, and more opposed to carbon dioxide targets, standards and accelerating the phase-out of internal combustion engines and fossil fuels.

- Many auto manufacturers and aviation companies advocate for climate action while simultaneously lobbying to weaken pro-climate policies. Automotive workers show greater unity on lobbying for a Just Transition.

- Transport companies’ inconsistent policy advocacy risks delaying the climate action they need to meet their own emission reduction targets.

- Policy advocacy to accelerate the uptake of electric vehicles has been strong among companies that have fleets and use transport services.

- Industry associations that cover multiple sectors but also cover transport have tended to take a more conservative approach to climate policy advocacy.

Accountability

- Disclosure of companies’ climate-relevant information is becoming mainstream – with over 18,000 companies disclosing to CDP in 2022, including 419 transport manufacturers and 930 transport service providers – but accountability gaps remain.

- Weaknesses include a lack of climate expertise at the board level in companies, and of financial incentives tied to emission reductions.

- The new ISO 14083 standard on quantification and reporting of greenhouse gas emissions from transport operations is expected to increase and improve disclosure.

- Little is known about the disclosure of companies (other than transport manufacturers and companies that provide transport services) on their transport emissions, targets and emission reduction efforts.

Opportunities to accelerate industry action

- Improving business climate leadership can help prevent greenwashing, as leaders must follow through on their ambition with credible action, advocacy and accountability.

- Companies can be leveraged for wider system change to complement technological changes and in responding to climate impacts.

- Companies can enhance their collaboration with other stakeholders in climate and sustainability, working with all partners in the value chain, supporting just transition pathways for transport and joining initiatives that truly help deliver the transition.

Author: Sophie Punte, We Mean Business Coalition

Contributors: Charlene Kouassi, Movin’On LABS Africa; Joachim Roth and Romain Poivet, World Benchmarking Alliance; Yann Briand, IDDR